Namibia relies heavily on rain-fed agriculture and imports over 60 percent of its electricity needs. Yet, this is endowed with enough renewable energy potential to become a regional powerhouse that could significantly reduce sub-Saharan Africa’s reliance on carbon-based fuels Primary infrastructure (roads, rail, air, energy, and telecommunications) is relatively well developed and modern. The economy is mostly export-driven. Mining, tourism, fishing, and agriculture are Namibia’s key industries . Namibia is richest in diamonds, gold, silver, tungsten, lead, zinc, tin, uranium, and copper and mining contributes ~10 percent to its GDP . Namibia’s GDP is expected to reach USD 12.7 billion in 2023 , the highest contribution comes from service sector followed by industries at 58 percent and 25 percent respectively.

Namibia has long relied on imported power from South Africa (Eskom). Namibia has a power purchase agreement with Eskom. which expires in 2025. However, NamPower has also diversified its sources of imported power over the short term by signing power purchase agreements with utilities in Botswana, Zambia, Zimbabwe, the Democratic Republic of Congo (DRC), and Mozambique .

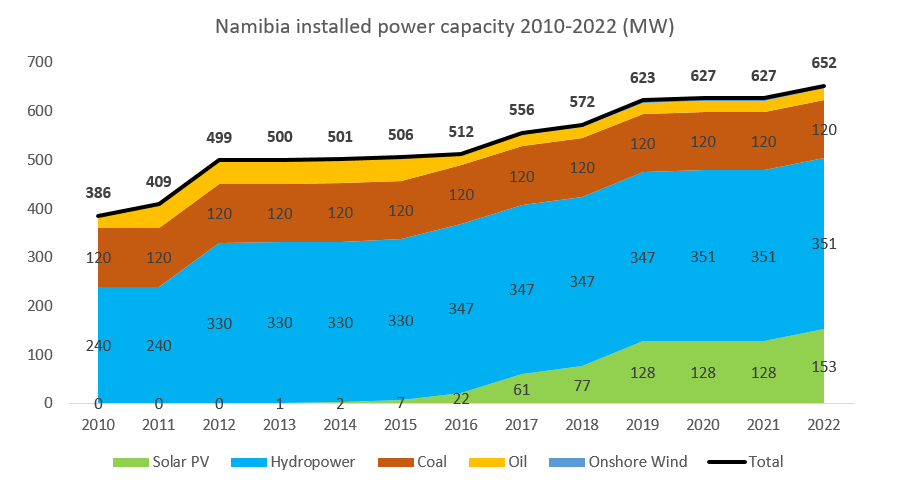

Namibia has a total installed power capacity of ~650 MW, with major contribution from hydropower (~54 percent). The country has immense potential for solar and wind power with high-capacity factors.

For detailed insights on Green Hydrogen, refer to Readiness Assessment of Green Hydrogen in African Countries, 2024.

Namibia may have a domestic demand of just ~100,000 tons/year of hydrogen in the future, currently most hydrogen is consumed in sectors such as ammonia fertilizers (~88 percent imported). Namibia has no refineries in the region.

Namibia can produce green hydrogen ~1.5 USD/kg by 2030 and could become a global low-cost supplier of choice if it can retain its competitive advantage in LCOH through low shipping costs. Namibia is looking to develop supplier relationships with Europe, Japan, South Korea, and China and is very open to discussing opportunities with other regions.

Namibia is aiming to become a green hydrogen superpower in the coming decade by positioning itself as a leader in the emerging markets and an international exporter of green hydrogen. Green hydrogen will be an important source of foreign investment and be important for the country’s energy security and transition. The government plans to use it extensively to decarbonize its own economy. Namibia has a potential to offer low-cost green hydrogen production (second only to Chile) owing to its abundance of solar and wind resources.

Based on its natural topography, domestic input factors (e.g., labor, land) and realistic achievable market share, Namibia aspires to reach green hydrogen production volumes of 10-15 Mtpa by 2050 (corresponding to 5-8% of expected international hydrogen equivalent trade volume13). Our ramp-up targets are:

Not Available

Not Available (NA)

Not Available (NA)