The global energy landscape is experiencing a quantum change as countries around the world endeavour to reduce greenhouse gas emissions and mitigate the impacts of anthropogenic climate change. Hence, renewable energy sources have emerged as a beacon of hope, promising sustainable and clean electricity generation. Among these, green hydrogen, produced through the electrolysis of water using renewable energy, has emerged as a viable clean fuel option, poised to decarbonise various sectors, including transportation, industry, and heating.

The Paris Agreement under the UNFCCC has emphasised on the global commitment to limit temperature rise to 1.5°C and atmospheric carbon dioxide (CO2) concentrations to 450 parts per million (ppm). The Agreement calls for concerted global efforts towards rapid, economy-wide decarbonisation. To help meet the ambitious goal of the Paris Agreement, as reiterated at COP 28, there is a clear need to decarbonise energy usage in hard-to-abate sectors. These sectors include steel, cement, chemicals (including fertiliser), long-haul road transport, maritime shipping, and aviation, where direct electrification can play only a limited role in reducing emissions. Consequently, clean chemical feedstocks or fuels like green hydrogen become exceedingly crucial for these sectors.

Green hydrogen is a clean and versatile fuel which is scalable and offers good sector coupling opportunities. As discussed above, it can be used for multiple sectors to help those sectors achieve their decarbonisation targets. Many industries and governments are researching on ways to incorporate hydrogen in their energy mix. Several governments are now providing policy support to produce, trade or utilise hydrogen in several end-use industries.

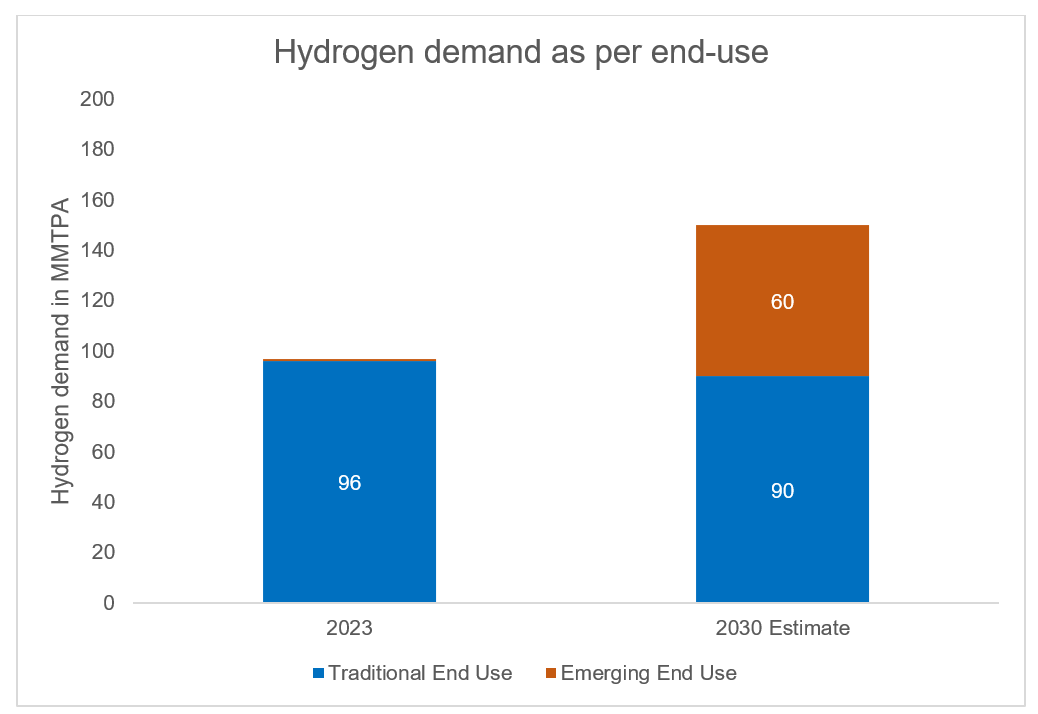

In 2023, the global demand for hydrogen stood at 97 million metric tonnes (MMT), driven predominantly by petroleum refining and the production of chemicals such as ammonia (for fertiliser use) and methanol[1]. In the Net Zero Emissions (NZE) scenario of the International Energy Agency (IEA), it is estimated that demand for hydrogen will surpass 150 MMT by 2030 [2].

Please read more about hydrogen and the exciting developments in this arena, in our newsroom section.

Some interesting facts about green hydrogen:

Green hydrogen has been in existence for quite a long time. About a hundred years ago in 1923, Asahi Kasei used hydroelectricity to power alkaline electrolysers to produce green hydrogen, which was subsequently used to create green ammonia

[1]

. Around the similar time period, Norsk Hydro in Norway developed an electrolyser plant in 1927, also powered by hydroelectricity, to produce green hydrogen and subsequently green ammonia for fertilisers

[2]

.

In 2023, the global demand for hydrogen stood at 97 million metric tonnes (MMT), driven primarily by petroleum refining and the production of chemicals such as ammonia (for fertiliser use) and methanol [1] . During the same year, the global production of low-carbon hydrogen for industrial use stood at a modest 1 MMT, representing a mere 1% of the total hydrogen produced [2] . However, as the push to decarbonise the industries intensify, the global demand for green hydrogen and its myriad applications is anticipated to skyrocket over the next two decades. In the NZE scenario of the IEA, it is projected that demand for hydrogen will surpass 150 MMT by 2030 [3] . Governments across the globe have thus far pledged policy support amounting to approximately USD 100 billion to foster the production of low-carbon hydrogen [4] . It is thus imperative for nations to ensure that the hydrogen produced is derived from clean or renewable energy sources, thereby aiding in meeting this burgeoning demand in a sustainable manner.

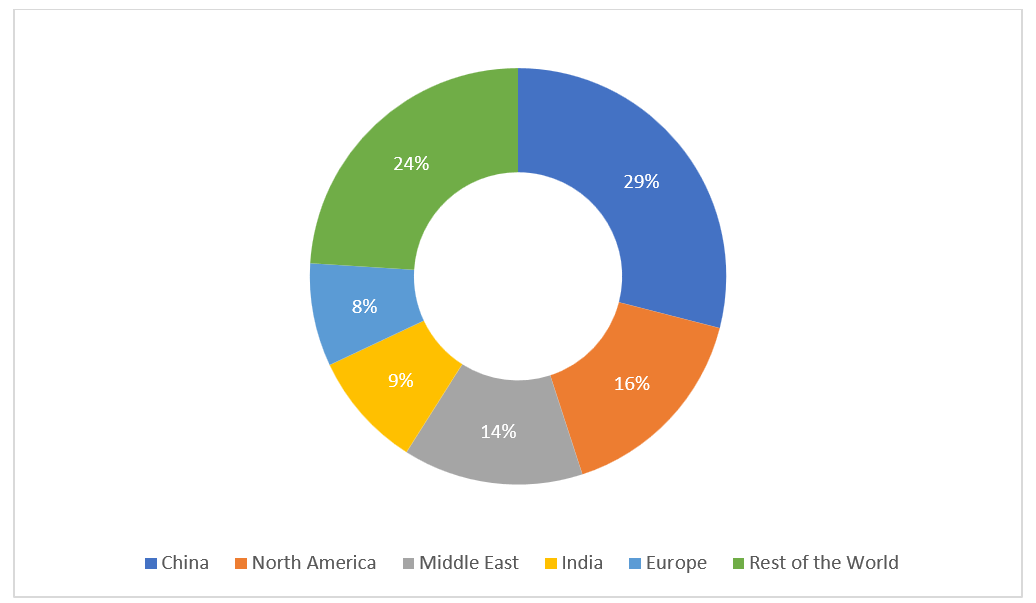

When it comes to regional distribution of hydrogen demand, China has the highest global demand of 29%, followed by North America (16%), Middle East (14%), India (9%), Europe (8%) and rest of the world (24%) [refer to Figure 1 [5] ].

Figure 1: Hydrogen demand by country, 2023

Hydrogen demand is mostly concentrated in oil refining and industrial sector (particularly fertilisers to produce ammonia). However, in 2030, emerging use cases like long distance transportation, long duration energy storage, power generation may also contribute significantly towards the demand. As per IEA’s NZE scenario, about 40 per cent of the global hydrogen demand in 2030 will be due to emerging use cases of hydrogen, which may include steel, transportation, e-fuels, power generation [6] . The corresponding usage in 2023 from such emerging use cases is barely 1 per cent (see Figure 2 [7] ). As per IEA’s Net Zero scenario estimate, there might be an 80-fold rise in hydrogen demand from emerging use cases in 2030, compared to the 2023.

Figure 2: Estimate of hydrogen demand as per end-use

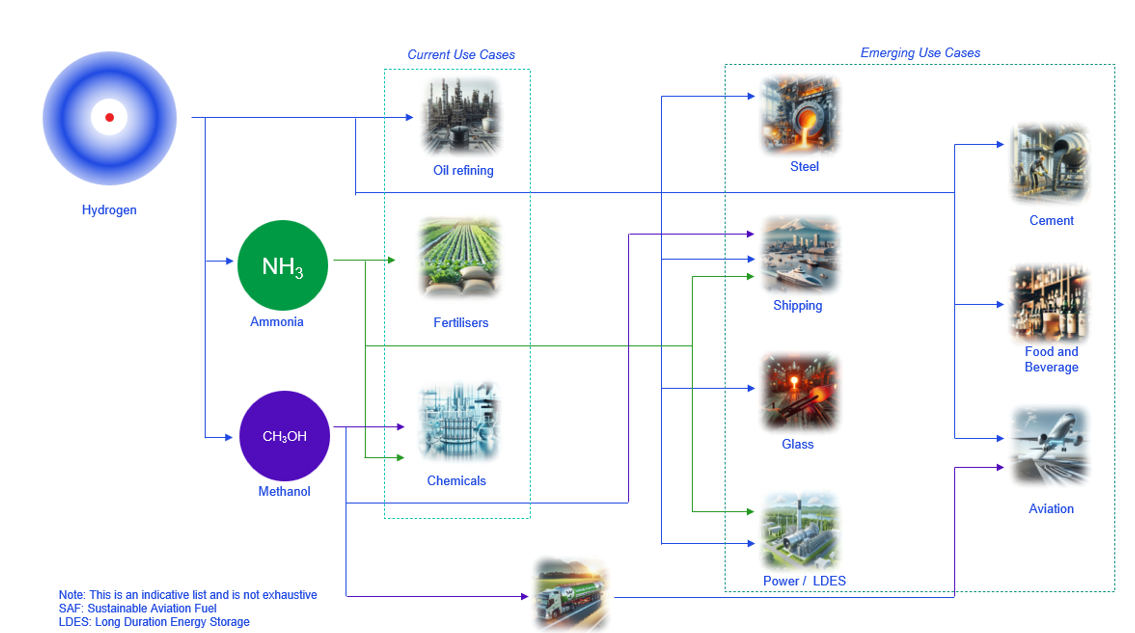

Hydrogen is a versatile clean energy vector which will find usage in a wide range of industrial sectors, displacing fossil fuels. Some of those use cases have been shown in Figure 3 [8] .

Figure 3: Indicative end-uses of hydrogen