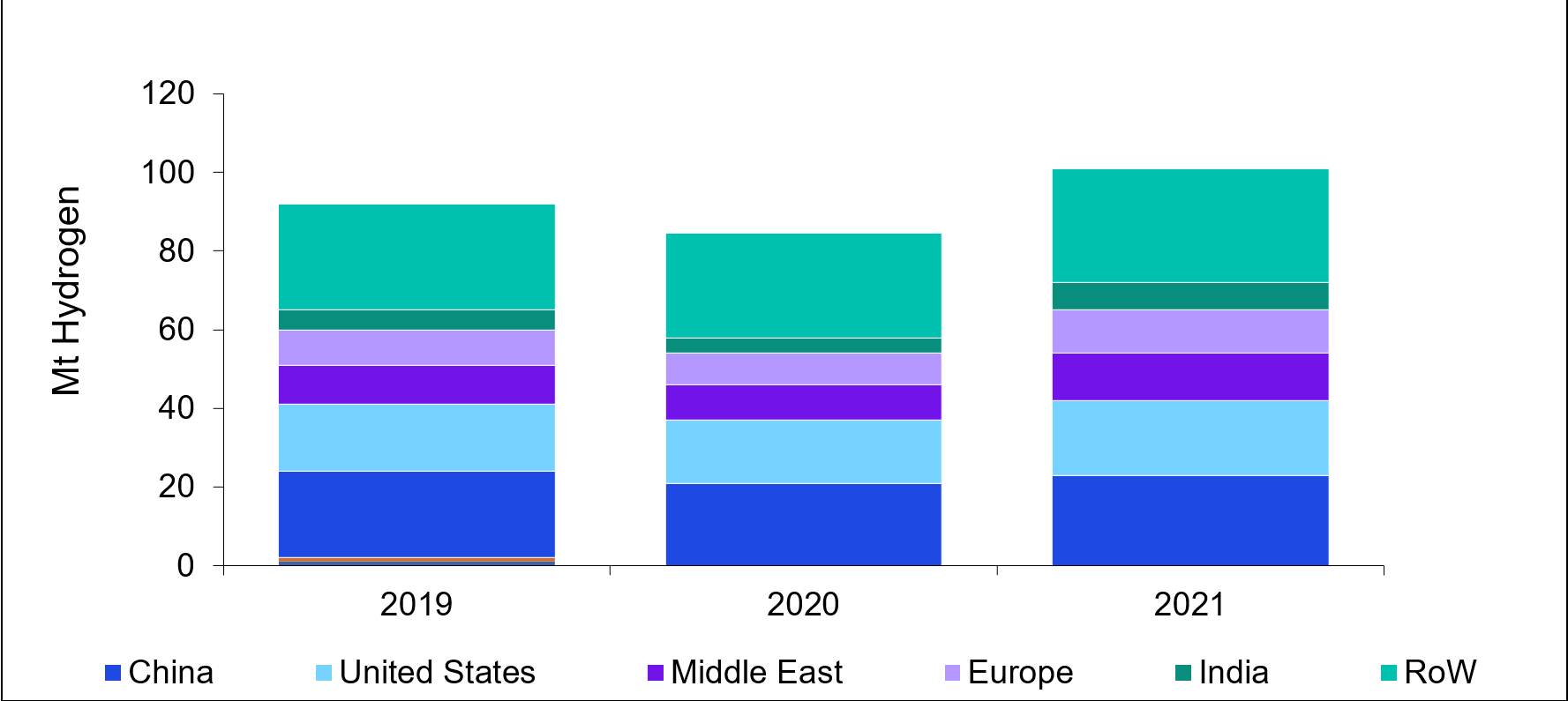

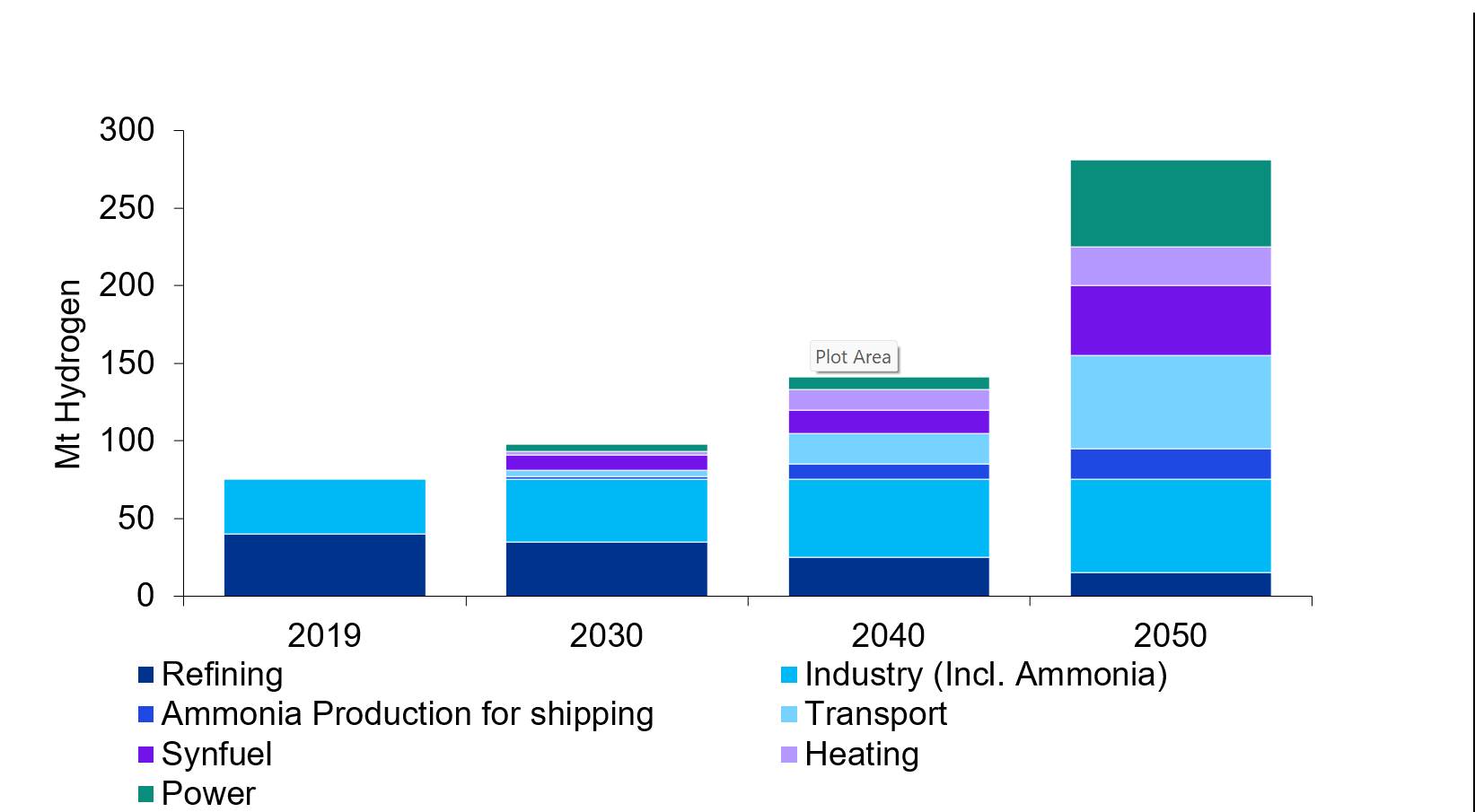

Global demand for hydrogen has increased since the 1980s, and as of 2021, demand is more than 94 MTPA and is growing currently at ~five percent. Most of the hydrogen currently being consumed is produced from fossil fuels (more than 90 percent) and the cost of production is based on local market costs of coal and natural gas. China is the world’s largest consumer of hydrogen, with demand of around 28 Mt in 2021, followed by the United States and the Middle East, both at 12 Mt of hydrogen demand in 2021. Europe and India trail with a demand close to 8 Mt each. The future growth of GH is expected to be led by the increased usage in current as well as emerging applications. Global hydrogen demand has the potential to grow threefold by 2050.

Europe and Australia are first movers in GH production. Based on the current project pipeline, GH production in Europe could reach close to 5 Mt by 2030. Australia is expected to become a global hub of GH production, with production quantity of 3 Mt by 2030, based on the project pipeline.

GH hubs are also being created in Latin America, North America, Middle East and Africa, projecting these regions as major export hubs for markets like EU and East Asia.

Electrolyser capacity has been growing at an accelerated pace for the past couple of years. 2021 saw a significant growth with over 200 MW of capacity in the operational stage. The total installed capacity stood at 0.5 GW and is expected to reach around 1.4 GW by the end of 2022. As depicted in the previous section, electrolysers are a critical technology for producing GH. In terms of technology, electrolysers are continuously evolving with several technologies under development.