Australia is one of the multicultural countries in the world, and home to the world's oldest continuing culture. It has a highly skilled workforce and a proud history of democracy and stable government(1). Australia is one of the world's leading producers of bauxite (aluminum ore), iron ore, lithium, gold, lead, diamond, rare earth elements, uranium, and zinc. Australia also has large mineral sand deposits of ilmenite, zircon and rutile. In addition, the country is home to large quantities of black coal, manganese, antimony, nickel, silver, Cobalt, Copper, and tin(2).

Australia is a substantial net exporter of energy, including coal and natural gas, with net exports for two-thirds of production. Around 90% of black coal energy production was exported in 2020-21, as was around 75% of domestic natural gas production and 83% of crude oil production (3). Australia is an economic powerhouse with a GDP of ~USD 1.55 trillion in 2021 (4).

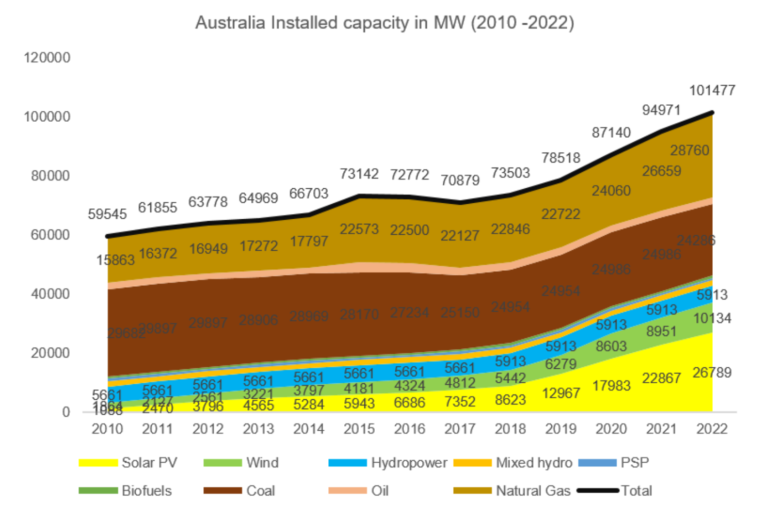

The total installed power capacity(5)stands just over 100 GW, with fossil fuels contributing ~52% and remaining supplied via renewable resources such as solar, wind and hydropower.

Most demand for hydrogen this decade is likely to be domestic - for chemical production, industrial processes and other uses. In the longer term, major export demand is expected from the Asia-Pacific .

Australia's current annual fossil fuel-based hydrogen production is approximately ~500,000 tons. Around 80 percent of the hydrogen produced is consumed in ammonia production for fertilizers and the remaining 20 percent is utilized by oil refineries in the country(6) .

Australia’s natural resources, investment environment and track record as an energy exporter provide a strong foundation to build a clean hydrogen industry. Even so, there is a need to be strategic, with scale and timing depending on how global demand evolves.

Hydrogen production in Australia

The Australian electricity sector is undergoing a significant transformation, moving from conventional thermal generation towards an increasing proportion of variable renewable energy (VRE).

Australian government announced hydrogen investment of AUD 35.2 billion in December 2022. Till date, roughly AUD 6.3 billion has been committed.(6)

The Australian Government is working to develop Australia’s Guarantee of Origin scheme, an internationally aligned emissions accounting framework. The scheme will help unlock economic opportunities for Australian industry to meet growing domestic and international demand for verified renewable energy and clean products. The GO scheme has been developed based on consultation, trials, and international engagement.

The nationally coordinated government actions as outlined in the National Hydrogen Strategy are listed below(7) :

Australia is well placed to play a significant role in the global green hydrogen industry due to its renewable energy potential. A good renewable energy potential spread across the geography is of critical importance as it can help bolster distributed generation of RE which can support green hydrogen production even in remote/sparsely populated areas of Australia.

Hydrogen also offers an opportunity for ‘sector coupling’ between the electricity, gas and transport sectors. For example, hydrogen produced from renewable energy can be injected into the gas network and used as a fuel input into different types of vehicles. This flexibility allows for greater optimization regarding use of renewable electricity across the different sectors(8) . Australia possesses large land areas (free of population/critical fauna) which can be utilized for renewable energy production, in doing so it promotes the opportunity of giga scale green hydrogen production plants spread across the country to cater domestic demand of hydrogen and promote export-oriented projects. This is the reason for multiple hydrogen hubs being currently developed in Australia.

Onshore wind energy potential is below world average with ~65% of the Australian land mass having the wind power density of ~260 W/m2 (low-range), and remaining land areas fall in the range of 260 to 560 W/m2 (low-medium range), whereas we observe some areas in higher power density range of 670 – 820 W/m2 (medium-high range).

Solar PV(11)

Rooftop solar potential(10) – 179 GW. Solar energy resource in Australia lies in the range of 1.6 to 2 MWh/kWp in ~80% of the land area, which is in medium to high range of the spectrum.

Electrolyser Manufacturing

FFI Gladstone: Construction of the world's largest electrolyzer facility has commenced the first stage of Fortescue Future Industries' (FFI) Green Energy Manufacturing Centre (GEM) in Gladstone Queensland. The facility will have initial capacity of 2 GW/annum by 2023(12) .

FFI Gladstone: Construction of the world's largest electrolyzer facility has commenced the first stage of Fortescue Future Industries' (FFI) Green Energy Manufacturing Centre (GEM) in Gladstone Queensland. The facility will have initial capacity of 2 GW/annum by 2023(12) .

ITM Power: TM Power (AIM: ITM) announces that the Western Australia (WA) Government is investing around A$225,000 with ITM Power Pty Ltd to understand the feasibility of manufacturing renewable hydrogen electrolysers within the State. Electrolyser manufacturing is a key initiative in implementing the Western Australian Renewable Hydrogen Strategy(13) .

Hysata: Hysata plans to have its first electrolyser manufacturing plant based in Australia(14)

There are currently 45 Australian projects planning to use hydrogen as a chemical feedstock for both domestic and export markets Six projects have moved beyond 'under development' status, and 23 involve ammonia production and have a combined announced capacity of 4.86 Mt per annum. Some landmark GW scale projects are listed below:

Edify Energy: T he project proponent has received Development Approval for a 1GW renewables-based hydrogen production facility to be located at the Lansdown Eco-Industrial Precinct near Townsville, Queensland(15) .

Hanwha Energy Corp. Hydrogen project: Giant Korean conglomerates Hanwha and SK Group have joined Korea Zinc in a proposed $20 billion-plus green hydrogen project in Queensland, paving the way for a flow of green energy exports between Australia and Koreaby 2032 that would gradually replace trade currently dominated by coal and gas. The hub has a potential generation capacity of up to 3000 megawatts. He estimated the total cost of the export project at more than $20 billion(16)

Green Springs Project: The project proponent is progressing with the development of a 10 GW (off grid) renewables-based hydrogen production facility with both a feasibility study and the first stage of FEED studies completed(17)

Cape Hardy Green Hydrogen Hub: Cape Hardy represents South Australia’s pre-eminent green hydrogen export opportunity with preferred developers well positioned to validate the potential of the site as the State’s hydrogen export hub of scale. At full scale the capacity is 4GW of electrolyser with and expected investment of ~AUD 23 billion(18)

Cape Hardy Green Hydrogen Hub: Cape Hardy represents South Australia’s pre-eminent green hydrogen export opportunity with preferred developers well positioned to validate the potential of the site as the State’s hydrogen export hub of scale. At full scale the capacity is 4GW of electrolyser with and expected investment of ~AUD 23 billion(18)

Central Queensland Hydrogen Project: The project plans involve a phased development with a commercial operations date of renewable hydrogen targeted for 2027 (Phase 1 production targeted at around 100 tons hydrogen per day, rated electrolyser capacity at around 280 MW), with scaled-up Phase 2 production capacity targeted at around 800 tons per day by the early 2030s (rated electrolyser capacity at around 2 gigawatts [GW], and which would require at least 7 GW of associated renewable solar/wind power generation capacity)(19) .

Murchison Hydrogen Renewables Project: The project would use combined onshore wind and solar energy of approximately 5.2 GW capacity to produce renewables-based hydrogen (3 GW) which would be converted to an estimated 2 million tons per annum (Mtpa) of ammonia, mainly for export to emerging green energy markets (with potential for domestic offtake as hydrogen or ammonia).

Hunter Energy Hub: Focus is on assessing the implementation of a large-scale renewables-based production facility ranging from a minimum 150MW and up to 2GW of hydrogen and its derivatives such as ammonia for export and domestic use. The study will review essential inputs, including renewable energy costs, firming requirements, electrolyser capital costs, logistics and utilization, etc. (20)

Australian Renewable Energy Hub: At full scale, the AREH aims to develop 26GW total generating capacity from wind and solar power. This is the equivalent of producing over 90 terawatt hours per annum and produce 1.6 million tonnes of green hydrogen per annum(21)