Introduction

Chile is a developing country with a high-income economy situated along the western seaboard of South America. It is one of South America's most stable and prosperous nations, leading the region in human development, competitiveness, and globalization. The country’s USD 317 billion[1] economy is supported by copper mining which makes up ~15 percent of Chile’s GDP and 60 per cent of its exports[2]. Overall, Chile produces a third of the world's copper. Apart from the mining activity, Chile’s economy is supported by manufacturing and services industry which contribute about 9 per cent and 55 per cent, respectively to the country’s GDP.[3]

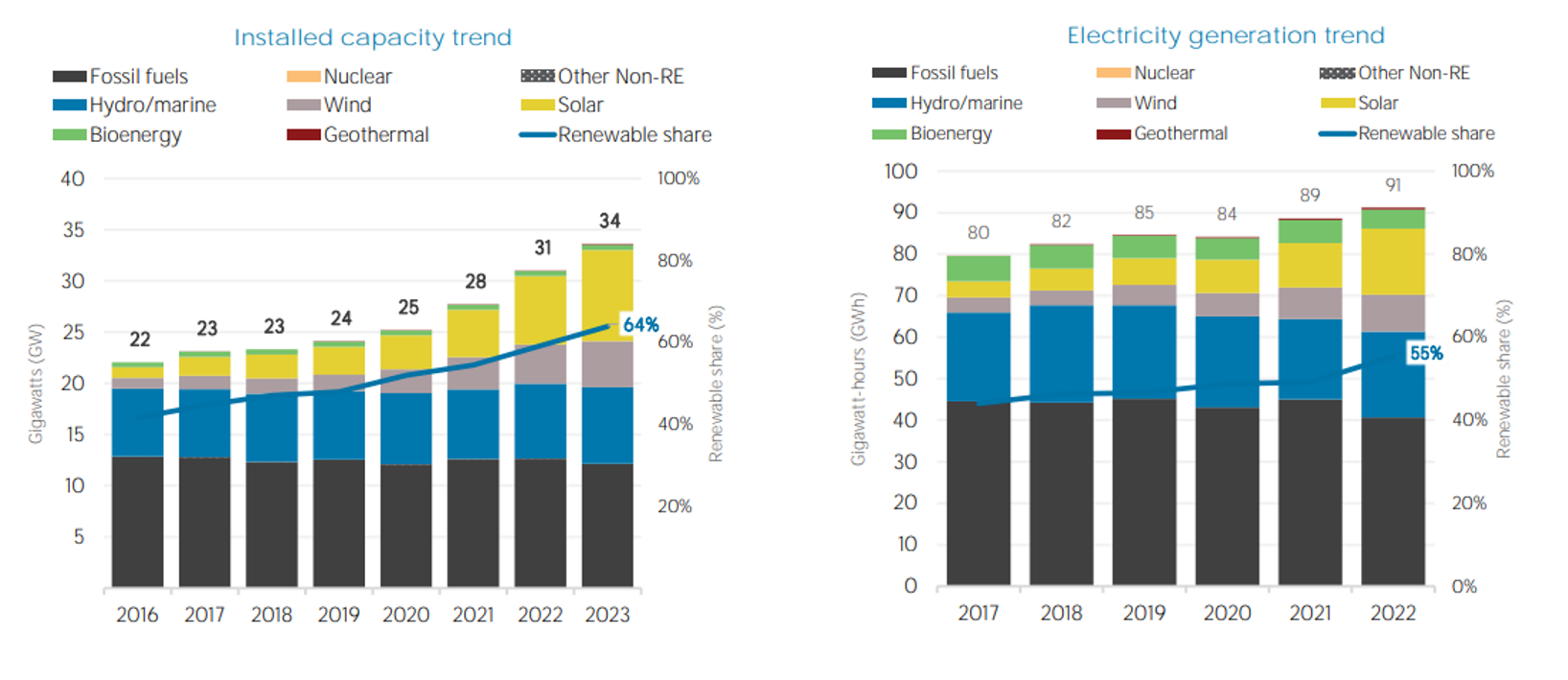

The energy sector in Chile is largely driven by fossil fuels, including oil, gas and coal, however, a remarkable renewable energy (RE) potential has led to an increase in its share in the installed generation capacity. The industrial and mining sector in Chile was the largest consumer of energy in 2020, accounting for 40 percent of the South American country's final energy consumption. Transportation sector accounted for another 33 percent of Chile's energy consumption in the same year. This was followed by electricity, representing 24 percent of the country's energy consumption.[4]

Coupled with abundant presence of RE, such as solar, hydro, wind and biomass in Chile, the high energy dependence on foreign fuel imports has pushed the country to adopt greener options. Almost all the fossil fuel - coal, oil, and natural gas (CONG) - consumed in Chile is imported. But the full spectrum of RE resources is there: Biomass, Geothermal, Solar, Hydro, Ocean, and Wind (BiGSHOW).

According to the U.S. Energy Information Administration in 2023, the country produced about 91 GWh of electricity, of which almost 40 percent came from thermal power plants, 20 percent from hydroelectric power plants and almost 40 percent from other renewable energy sources.

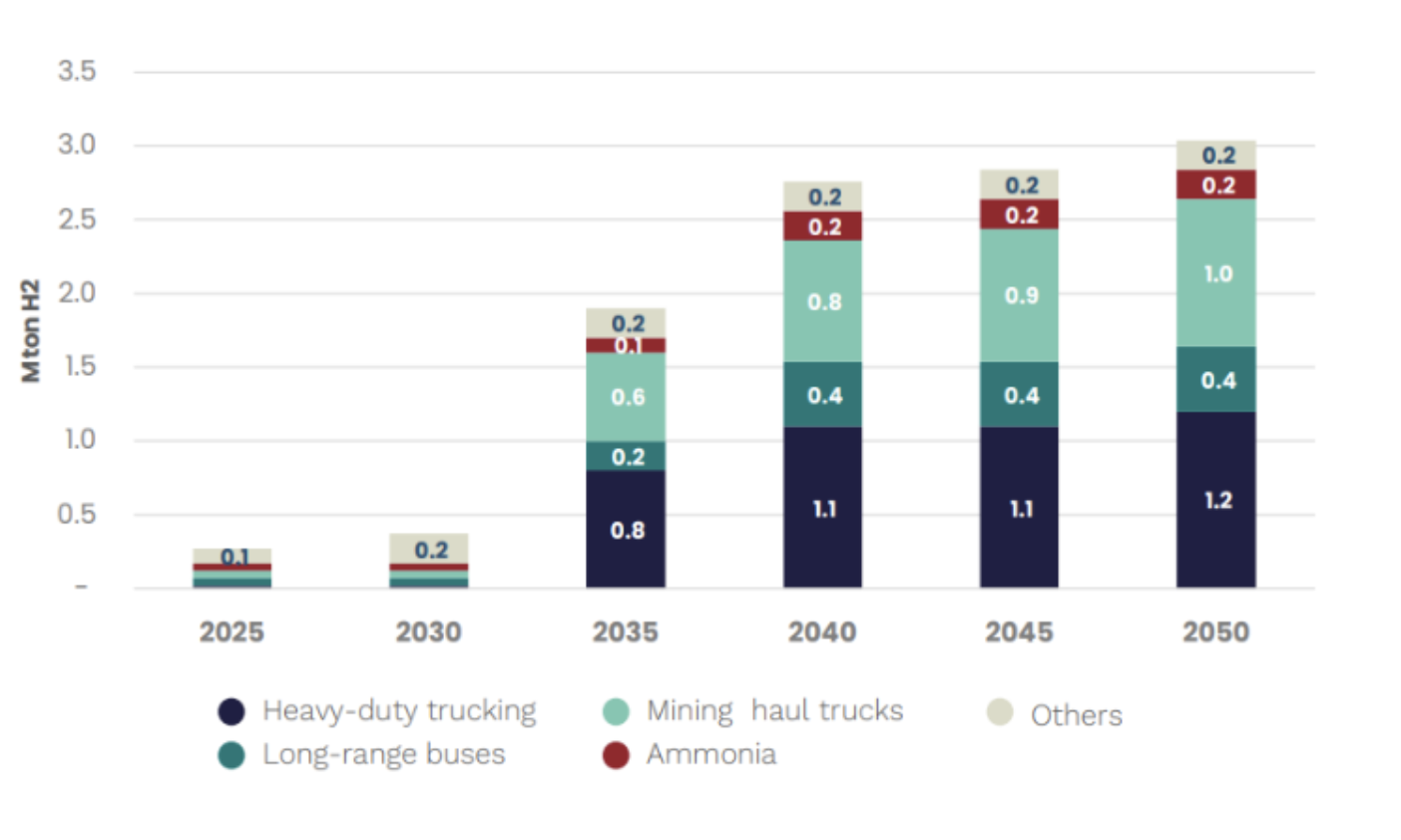

As of 2019, Chile had a hydrogen demand of 0.2 Mt per annum. (5) The country has only a few heavy industries that are conventional consumers of hydrogen, such as steel, chemicals, petroleum refineries, and fertilizer manufacturing. As reflected in the figure below, mining and metals industry in Chile is being promoted as the primary beneficiaries of green hydrogen development plans and policies, with heavy duty trucking and mining haul trucks making up for most of the hydrogen demand in future.

The energy transition can drive the broader economic transition. The traditional mining industry - digging giant holes in the ground -- can be replaced in part by "mining" RE resources which are inherently sustainable. This has led to Chile experiencing a remarkable clean energy transformation over the past few years.

Mining sector is an essential part of Chile and is the backbone to its development. Thanks to its comparative advantages, such as the high concentration of copper deposits, Chile is positioned as a competitive producer of minerals, such as copper and lithium. Mining companies in the region are looking up to hydrogen to slash operational costs by eliminating the expensive import of diesel.

Refineries in the country have taken steps to include green hydrogen in their chemical process. Chile’s massive mining industry is in the frontline, developing pilot projects chiefly in the sphere of industrial transport, such as excavators and haul trucks. Plans for hydrogen deployment in the processing phase are also on the drawing board. And now the country’s air transport sector has also entered the arena. Public transport sector in Chile has also been identified as a target for green hydrogen intervention.

Fertilizer or urea producing facilities are an ideal consumer segment for green hydrogen, however, Chile does not have any major fertilizer or urea plants.Based on products manufactured by the chemical industry and the noticeable lack of large organic chemical production units, there is limited scope for green hydrogen to be used in the industry.

Chile’s frontrunner role is underlined by the governments pledge to net-zero by 2050, highlighting shutting two thirds of coal plants by 2025. This goal is supported by a Just Transition Strategy, currently being developed by the government. It also includes a focus on green hydrogen and electric mobility, in line with the respective National Hydrogen Strategy (2020) and the Electromobility Strategy (2022). The former aims for 5 GW of electrolysis capacity by 2025, while the latter lays out a goal of 100% electric vehicle sales by 2035.

Chile's Ministry of Energy presented a National Strategy for Green Hydrogen with three main objectives:

The Chilean government has set a target of producing 1 million tonnes of green hydrogen and attaining a target price of USD 1.5 per kg by the year 2030. The Ministry projects that Chile could produce up to 1.6 million tonnes per year of green hydrogen and become the leading low-cost exporter by 2040, when the local market will be worth an estimated USD $33 billion (including USD $24 billion in exports).

In 2022, Chile’s Ministry of Energy published an update to its the Long-Term Energy Policy (Planificación Energética de Largo Plazo, first published in 2015), which re-emphasizes the pledge to net-zero, laying out a clear decarbonisation pathway that addresses all sectors of the national economy.

The Chilean policy for green hydrogen also provides for modifications to standards and safety regulations to include hydrogen as an energy carrier and allow for bylaws to be emitted to regulate safety issues along the value chain. To achieve the hydrogen targets, the government, through its ministries, mainly the Energy, Mining and Transport Ministries, has set out a regulatory roadmap, anticipating a series of regulations, such as, Hydrogen Facilities General Regulation, Multi-Fuel Service Stations Regulation, Technical, Construction and Security Requirements for GH2 (gaseous state hydrogen) Powered Vehicles Regulation, and Hydrogen Systems for Mining Operations Regulation.

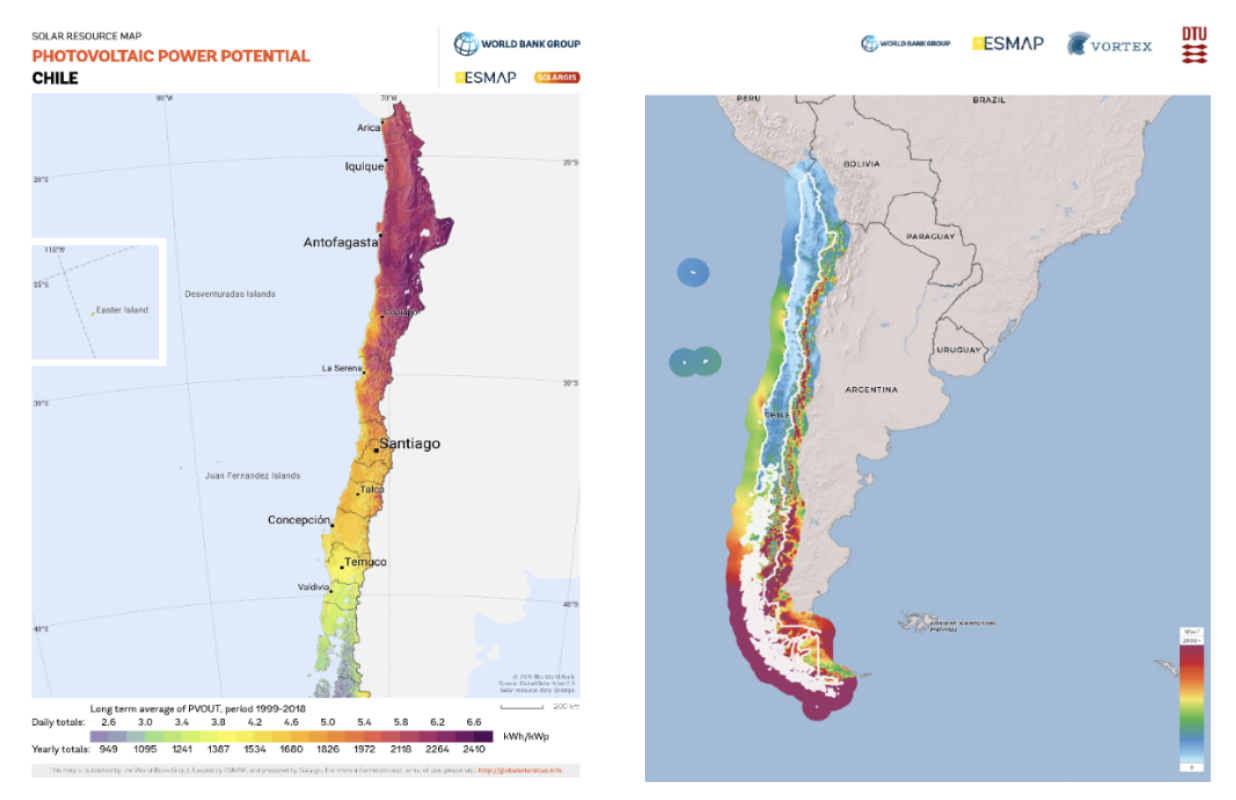

Chile also boasts an infrastructure that could be repurposed for green hydrogen production, particularly the mining sector in the Atacama Desert. Chile's best solar resources are in the Atacama Desert region and more broadly in the northern 1/3 of the country, as mentioned above. Mining operations are some of the "anchor" customers for some of these big solar projects. Given a status as an exporter of commodities, such as copper, Chile has a well-established infrastructure base to position itself as one of the largest exporters of green hydrogen over the next few years.

Chile has a unique opportunity to develop a competitive green hydrogen industry that forms an energy source for local use and exportation, and promotes a sustainable economy around it. Stretching from Atacama Desert in the north to Patagonian south, Chile draws on abundant RE. The capacity has already grown five times since 2015 and the government expects to generate up to 70 percent of its electricity through clean energy by 2030, as RE prices keep falling down. (7)

With high solar radiation and onshore winds, Chile’s geography provides both renewable energy opportunities and challenges. The country’s greatest solar resource lies in its far north in the Atacama Desert, which has a potential of 9 kWh per m2 a day, the highest in the world. Chile also has an extensive coastline providing numerous onshore wind sites with good wind speeds, the best is found in the remote Patagonian region in the country's far south.

Solar generation in the north is perfectly positioned to supply energy to the country’s mining operations. Transmission capacity has been the key to unlocking the renewable potential of the north. In addition, the new interconnections have reduced grid congestion and allowed renewable electricity to flow south. As of 2021, Chile has 29.5GW of installed electricity generation capacity already in operation. The energy matrix breaks down into the following - solar 18%, coal 16%, diesel 14%, wind 13%, natural gas 13%, hydroelectric dams 12%, and run-of-the-river hydroelectric 11%. Biomass, geothermal energy, and other technologies make up the remaining amount.

Rich RE environment and presence of a pan-country transmission network makes renewable energy widely available across the length and breadth of the country. This in turn comforts site selection for green hydrogen projects for investors and developers. A mobile green hydrogen pilot plant was opened in Antofagasta to validate the feasibility of producing green hydrogen with solar photovoltaic energy.

The Chilean government has unveiled plans to provide subsidies of up to USD 10 million for the construction of new electrolyser factories or assembly plants in the country. Government agency Corfo has opened a call for submissions for the subsidy

.With these enabling factors in place, the Chilean development agency has selected and approved six hydrogen projects with a cumulative electrolyzer capacity of 396 MW to be supported by public sector funds totaling USD 50 million from companies such as:

| S.No | Project | Developer | Funds (USD/Million) | Electrolysis capacity (MW) | Project description |

|---|---|---|---|---|---|

| 1 | Faro del Sur | Enel Green Power Chile | 16.9 | 240 | Production of some 25,000 tonnes of H2/year via wind-powered electrolysis. Off-taker is e-fuels producer and exporter HIF Chile |

| 2 | HyPro Aconcagua | Linde | 2.4 | 20 | 3,000 tonnes/year of green H2 to replace some of the grey hydrogen at ENAP's oil refinery in Aconcagua |

| 3 | HyEx - Produccion Hidrogeno Verde | Engie | 9.5 | 26 | Pilot plant to produce 3,200 tonnes/year. Off-taker Enaex to convert green H2 to ammonia |

| 4 | Antofagasta Mining Energy Renewable (AMER) | Air Liquide | 11.8 | 80 | Green H2 to be combined with captured CO2 to produce 60,000 tonnes of e-methanol per year |

| 5 | Quintero Bay Green Hydrogen | GNL Quintero | 5.7 | 10 | Green H2 plant to produce some 430 tonnes/year. Output to be sold to industrial companies in Quintero Bay area |

| 6 | H2V CAP | CAP | 3.6 | 20 | Green H2 plant to produce 1,550 tonnes/year for green steel making |

The Chilean government picked the above mentioned six projects and expects to attract around USD 1 billion worth of investments and bring the country close to 400 MW of electrolysis capacity.