Egypt, one of the most populous countries in the Middle East and North Africa (MENA), is home to over 109 million inhabitants.[1]Traditionally, its economy has been driven by fossil fuels, with crude oil being the fourth most exported product.[2] This reliance on oil and gas makes Egypt vulnerable to price shocks and demand fluctuations due to geopolitical factors and global net-zero commitments. Therefore, transitioning to renewables and green hydrogen is essential.

Egypt plays a crucial role in the hydrocarbon industry. As of the latest estimates, it was the second-largest producer of total liquid fuels in Africa among non-OPEC countries in 2023, just after Angola. Additionally, in 2022, Egypt was the second-largest natural gas producer in Africa, following Algeria.[3]

Between 2013 and 2022, Egypt's total electricity capacity almost doubled, increasing by around 27 GW. This significant growth was largely due to fossil fuel-based electricity sources. However, there was also notable progress in non-hydroelectric renewable energy, such as solar and wind, which reached a capacity of 3.4 GW by 2022.[4]

Egypt is actively working to diversify its power generation by developing renewable energy sources. As part of its 2035 Integrated Sustainable Energy Strategy, the government aims for 42 per cent of the country's total energy capacity to come from renewable sources by 2035.[5] Egypt has extensive land resources and abundant solar and wind energy potential, making it an ideal location for renewable power generation. The high potential of renewables, combined with increasing energy demand, has led to a significant push for expanding renewable capacity.

[4] U.S. Energy Information Administration, International Energy Statistics database, accessed April 17, 2024. “Powering Egypt: gas to continue dominating power mix despite surging renewables,” Rystad Energy, March 19, 2024.

For detailed insights on Green Hydrogen, refer to Readiness Assessment of Green Hydrogen in African Countries, 2024.

Hydrogen demand in Egypt is expected to come from sectors like refining, fertilizers, and steel. Currently, the refining and fertilizer industries use hydrogen produced from fossil fuels for processes such as hydrotreatment, desulfurization of crude, and ammonia production for fertilizers. Although the steel sector does not currently use hydrogen, it is anticipated to adopt hydrogen in the future, depending on technological advancements and legislative support.

For estimated green hydrogen demand in the country, refer to the detailed study by International Solar Alliance – Readiness Assessment of Green Hydrogen in African Countries, 2024.

In August 2024, Egypt launched its National Low-Carbon Hydrogen Strategy to diversify its energy sources and transition to a low-carbon economy. The government expects this strategy to boost the country's GDP by USD 18 billion and create over 100,000 jobs by 2040. The plan focuses on increasing hydrogen production, promoting its use in various sectors like industry and transportation, and enhancing Egypt's role in the global hydrogen market.[1]

Strategic Objectives:

Implementation Phases:

Production Targets:[2]

Investment and Infrastructure:

A new desalination plant at Sokhna is planned to support the burgeoning green hydrogen industry.

Egypt’s regulatory framework for low-carbon hydrogen is evolving to create a conducive environment for investment, production, and export of green hydrogen.

Established in 2023, this is the primary body overseeing the implementation of Egypt’s low-carbon hydrogen strategy. It includes representatives from key ministries:

Egypt has introduced strong incentives for hydrogen investors, including:

A dedicated portal has been launched to ensure transparency and ease of doing business:

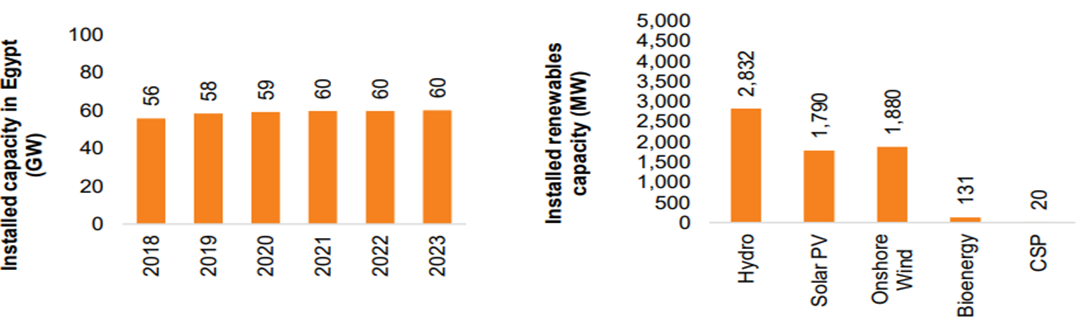

Egypt has set an ambitious goal to generate 42 per cent of its electricity from renewable sources by 2030. This target includes contributions from wind (14 per cet), concentrated solar power (CSP) (5.52 per cent), solar photovoltaic (PV) (21.3 per cent), and hydropower (1.98 per cent). Currently, Egypt's renewable energy installations total 6.6 GW out of a total installed power capacity of 60 GW. This includes approximately 2.8 GW from hydropower (about 42 per cent), 1.8 GW from solar (around 27 per cent), and 1.9 GW from wind (29 per cent). [1]

Figure: Installed capacity and renewable energy share in Egypt (2023) (ISA 2024)

Egypt benefits from 2,900 to 3,200 hours of sunshine annually, with an average annual direct normal irradiance (DNI) of 5.25-6.36 kWh/m² per day and a global horizontal irradiance (GHI) ranging from 5.52 to 6.26 kWh/m² per day, varying from north to south. Additionally, the vast artificial reservoir, Lake Nasser, upstream of the Aswan Dam on the Nile River, has the potential to host floating solar power plants, which could generate an estimated 32.8 TWh of energy from floating solar alone.[2]

Egypt is well-suited for installing concentrated solar power (CSP) systems, which are beneficial for both energy storage and power generation. The country enjoys average annual wind speeds of 8–10 m/s at a height of 100 meters along the Red Sea coast and 6–8 m/s along the southwest banks of the Nile River and in the southern part of the Western Desert.

To achieve its ambitious renewable energy and green hydrogen goals, Egypt is actively implementing policy measures and fostering markets and partnerships.

[1] PowerPoint Presentation – ISA Readiness Assessment for Green Hydrogen in African Countries 2024

[2] PowerPoint Presentation – ISA Readiness Assessment for Green Hydrogen in African Countries 2024

As of 2025, Egypt does not have established facilities for manufacturing electrolysers, which are essential for green hydrogen production.

According to the International Energy Agency (IEA), Egypt has announced 28 green hydrogen projects as of 2023, making it one of the leading countries in Africa for such initiatives. Most of these projects are aimed at exporting green hydrogen to meet the ammonia import demands of markets in Europe, Japan, and South Korea.[1]

While most of these projects are still in the concept or MoU stage, some have secured dedicated off takers for products like ammonia, methanol, hydrogen, and steel (Refer Table below, ISA 2024).

Project Name | Size |

Total Eren | 1.8 MMTPA Ammonia |

Renew Power | 1.7 MMTPA Ammonia |

Maersk SC Zone | 48 KTPA Hydrogen |

Jindal Green Steel SC | 3 MMTPA Green Steel |

Fortesque | 9.2 GW electrolyser |

In addition to the projects mentioned above, noteworthy announcements were made in the year 2024-25 in the country -

[1] Egypt signs 7 MoUs in green hydrogen and renewable energy with giant global developers - Energy - Business - Ahram Online

[2] Fertiglobe says 100-MW Egypt hydrogen project set for FID in H1 2025 | Hydrogen News | Renewables Now

Image Source: freepik