The European Union operates as a single comprising of 27 countries. The GDP in the EU in 2021 was 15.5 trillion USD (1) The European Union is the third-largest economy in the world and accounts for one-sixth of global trade. The GDPs of Germany, France and Italy make up more than half of the EU's entire economic output (2)

The EU has four primary sectors of economic output: services, industry, construction, and agriculture (including fishing and forestry(3) The EU economy relies heavily on the services sector, accounting for more than 70 percentof the GDP in 2020. It also is the sector with the highest share of employment in the EU, at 73 percent.(4)

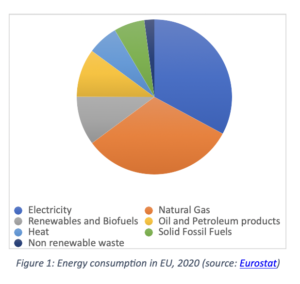

Electricity and natural gas accounted for nearly two-thirds of energy consumption in the EU's industry sector. Renewables and biofuels accounted for 10 percent of the total.

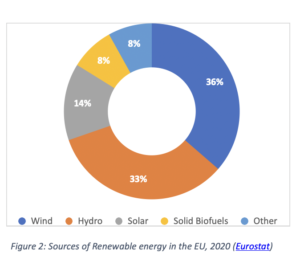

In 2020,renewable energy sourcesmade up 37 percent of gross electricity consumptionin theEU, up from 34 percent in 2019. Among the EU Member States, more than 70 percent of electricity consumed was generated from renewable sources in Austria (78 percent) and Sweden (75 percent). The generation of electricity from renewable sources was also high and accounted for more than half of the electricity consumed in Denmark (65 percent), Portugal (58 percent), Croatia and Latvia (both 53 percent).(5)

Hydrogen accounts for less than 2 percent of the EU's current energy consumption and is mostly used as feedstock in industrial processes, notably oil refining, ammonia, and methanol production, but also as an energy carrier for space rockets (6) .According to the 2020 Clean Hydrogen Monitor, around two thirds of hydrogen in the EU are produced on site for specific production processes.

The currently dominant technology, accounting for around 96 percent of hydrogen production, is steam methane reforming to produce hydrogen from natural gas or coal. While being cost-effective, this process generates significant CO2 emissions (i.e., grey hydrogen).

The sectors in EU which could benefit from clean hydrogen use include- steel, chemicals and cement, transport (heavy-duty vehicles, rail and maritime), and the power sector.(7)

According to the EU’s hydrogen strategy at least 6GW of;electrolyserspowered by renewable energy should be installed between 2020 and 2024. Depending on its utilization, such capacity could produce up to 0.8Mt of clean hydrogen, annually. This number should then increase to 40GW by 2030.(8)

The EU strategy on hydrogen(COM/2020/301) was adopted in 2020 and suggested policy action points in 5 areas: investment support;support production and demand; creating a hydrogen market and infrastructure; research and cooperation and international cooperation. The full list of 20 key actions was implemented by the first quarter of 2022. Hydrogen is also an important part of the strategy for ‘energy system integration’.( 9)

Since the Fit-for-55 package(July 2021) has put forward several legislative proposals that translate the European hydrogen strategy into a concrete European hydrogen policy framework. This includes proposals to set targets for the uptake of renewable hydrogen in industry and transport by 2030. It also includes the Hydrogen and decarbonized gas market package(COM/2021/803 final and COM/2021/804 final), which puts forward proposals to support the creation of optimum and dedicated infrastructure for hydrogen, as well as an efficient hydrogen market.

As stated in the RePowerEU communication, action plan and roadmap, the European Commission aims to reduce European dependence on Russian energy, particularly through clean hydrogen. RePowerEU calls for an EU production target of 10 million tons of clean hydrogen by 2030 along with 10 million tons of imported clean hydrogen by 2030. Hydrogen is expected to play an important role in achieving EU objectives to reduce greenhouse gas emissions by a minimum of 55 percent by 2030 and reach net zero emissions by 2050.(10)

Standards and Certifications of Green Hydrogen in the EU

CertifHy initiative undertaken by a consortium led by HINICIO, composed of the Association of Issuing Bodies (AIB), GREXEL, Ludwig Bölkow System Technik (LBST), CEA, and TÜV SÜD and financed by the Clean Hydrogen Partnership. The initiative started in 2014 and is now already in its third phase of implementation. Across the first two phases, the CertifHy Scheme was designed, and the Green and Low-Carbon Hydrogen labels were established. Following that, different procedures for GO issuing, transfer and cancellation were elaborated and subsequently tested through a pilot.This provided the basis for the first non-governmental Guarantee of Origin scheme for Hydrogen in the world

A GO is an electronic document providing proof that a given quantity of hydrogen is produced by a registered production device with a specific quality and method of production. The GO certificates are maintained in a CertifHy Registry, a central database that will manage the GOs' life cycle for every account holder .

On 10 February 2023 the European Commission adopted two delegated acts related to the production and certification of renewable hydrogen. The Delegated Regulation on Additionality establishes the rules for production of RFNBOs (Renewable fuels of non-biological origin). The Delegated Regulation on GHG Savings establishes rules for calculating life cycle GHG emissions for RFNBOs. The rules apply to domestically produced and to imported hydrogen.(11)

There has been a record surge in RE generation, specially solar power, growing by a record 24 percent last year which almost doubled its previous record, with wind growing by 8.6 percent. 41 GW of solar power capacity were added in 2022, almost 50 percent more than the year before. Ember says that 20 EU countries achieved new solar records in 2022, with Germany, Spain, Poland, the Netherlands, and France adding the most solar capacity.

The highest share of renewables can be found in Sweden, at a considerable 53.9 percent. Next on the list is Finland (39.3 percent), Latvia (37.6 percent), Austria (33.0 percent) and Denmark (30.8 percent).

The focus in the first phase is on scaling up manufacturing of large (up to 100 MW) electrolysers, decarbonizing existing hydrogen installations and facilitating the take-up of hydrogen in end-use applications. Planning for transport infrastructure and laying down regulatory frameworks to ensure a well-functioning hydrogen market are key policy actions. (11)

In the second phase (2024-2030), infrastructure will be increasingly deployed, starting with local networks on islands, remote areas, or local hydrogen clusters, where hydrogen would be used not only for renewable energy balancing but also in industry and transport applications and for residential and commercial heating.9

In terms of installed production capacity in the first two phases, the strategic objective for 2024 is at least 6 GW of renewable hydrogen electrolysers producing 1 million tons renewable hydrogen, climbing to 40 GW in 2030 with 10 million tons of renewable hydrogen production.(11) .