France, with a GDP of 2.7 trillion USD in 2022, is mainly driven by theservice sector, which accounts for over 70 Percent of GDP.(1) France is also a leader in industries such as aerospace, automotive, cosmetics, luxury goods, and tourism.

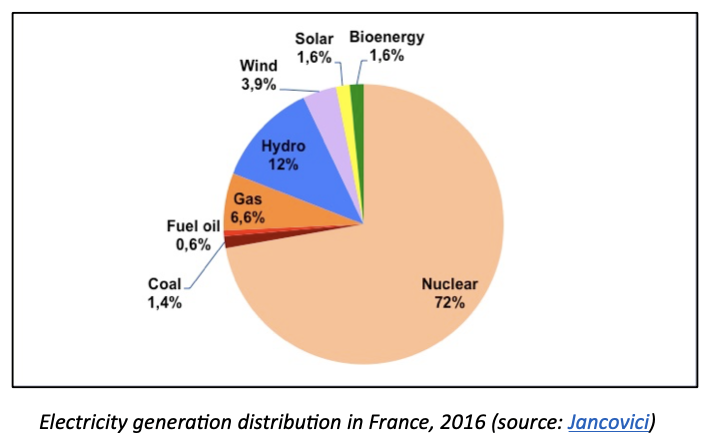

The French energy sector is a mature market subject to a strong competition. Approximately two-thirds of France’s electricity comes from the country's nuclear reactors, and France has been an electricity exporter for the past 30 years. Just over half of the country's energy is provided by primary domestic production. France imports most of its fossil fuels and has extensively diversified its geographic sourcing. With less greenhouse effects, electricity and gas have progressively replaced oil and coal use in the main industrial sectors, although oil-based products are still the norm in the transportation sector.(2)

Renewable energy is taking on a growing share in the country's energy mix, representing a target of 25.3 Percent of France’s gross final energy consumption for 2022. French government support for renewable energies increased 25 Percent with a commitment of USD7.06 billion in 2021.

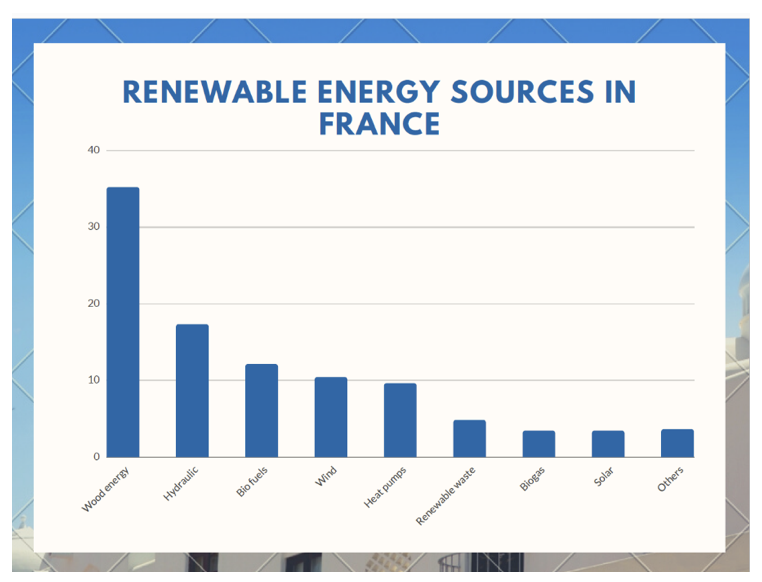

Renewables support approximately 60,000 full-time jobs. The Renewable energy sector is very diverse, covering ten different sub-sectors: Wood energy: 35.2 Percent - Hydraulic 17.3 Percent - Biofuels 12.1 Percent - Wind 10.4 Percent - Heat pumps 9.6 Percent - Renewable waste 4.8 Percent - Biogas 3.4 Percent Solar 3.4 Percent . Others (geothermic, agriculture, marine) 3.6 Percent . The most developed renewable energies are still wood energy and hydropower, but onshore windfarms and heat pumps are two sectors that have progressed the most in the last few years with offshore windfarms currently under development. In absolute levels among the EU Member States, France is the largest producer of hydroelectricity and the second largest for biofuels. (2))

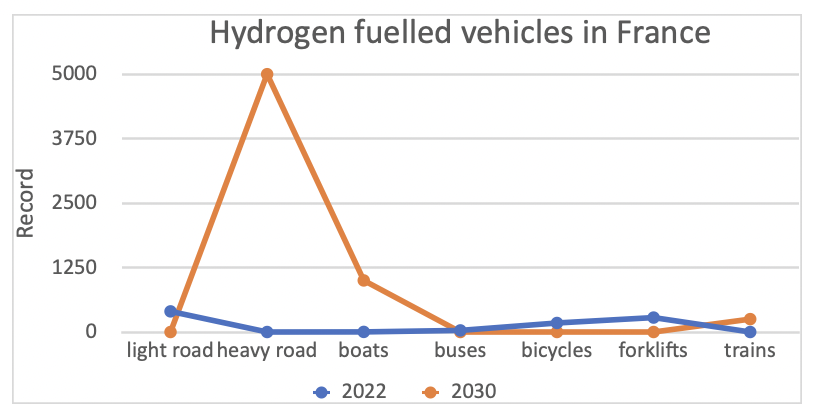

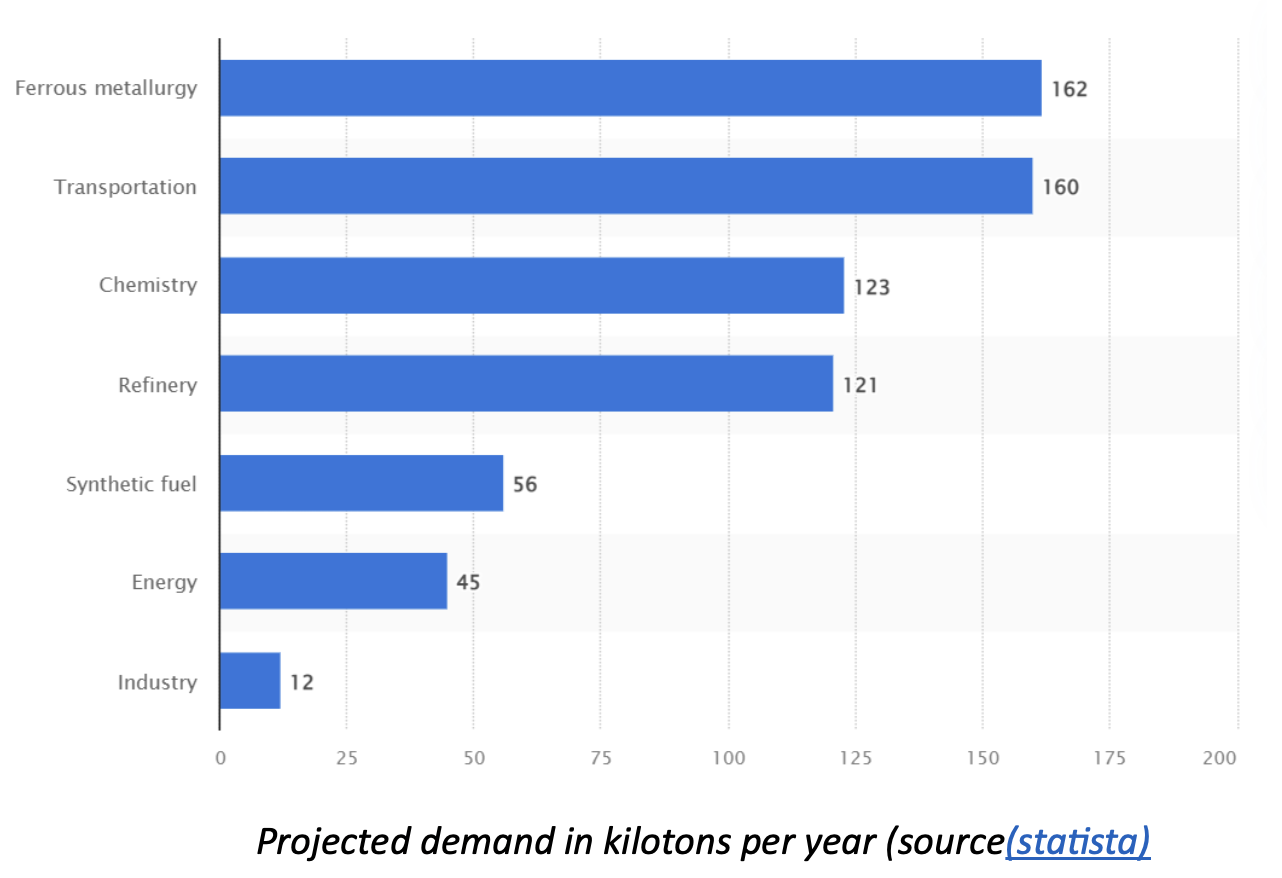

Transportation sector has witnessed a steep rise in the demand for hydrogen. Heavy road vehicles, boats, and trains fueled by hydrogen are expected to increase notably. In France, hydrogen demand for transportation is projected to be 160 kilotons in 2030. (3)

In France 900,000 tonsof hydrogen are produced annually to meet the needs of the industry. The French hydrogen sector, therefore, has a strong export potential that could reach a turnover of USD 7 billion in 2030 and 16.2 billion USD in 2050.

The ferrous metallurgy and the transportation sectors are expected to account for the highest demand of carbon-free hydrogen in 2030. Overall, it is estimated that around 70 percent of the hydrogen used in 2030 will be for industrial purposes. Only around seven percent of the demand would come from the energy sector. In the transportation sector, hydrogen would be used for light and heavy road vehicles, maritime transportation, and trains.

France set out in its 2020 hydrogen strategy ambitious goals of becoming a world-leader in the hydrogen sector. One important tool in furthering this strategy is the development of a clear regulatory scheme tailored to the hydrogen ecosystem. Recently, the Government published a draft hydrogen ordonnance (The Draft Hydrogen Ordonnance) setting out the following:

This detailed legal framework aims to promote the French hydrogen sector development, by referring to three different types of hydrogen distinct from European definitions (renewable hydrogen, low carbon hydrogen and fossil hydrogen). To be qualified as renewable hydrogen, hydrogen must be produced (1) either by electrolysis using electricity produced by renewable energy sources or by any other technology using exclusively one or more renewable energy sources, and (2) whose production process does not exceed a greenhouse gas emission threshold. (4)

One of the three key priorities of this strategy is greening the use of grey hydrogen in industry by creating an electrolysis sector. In this respect, France has set out targets to achieve by 2030. These include:

The French Government announced USD7.75 billion of investment in hydrogen sector till 2030. The objective is to provide the national territory with a network of filling stations with sufficient hydrogen supplies to enable the use of hydrogen vehicles. This would involve the creation of refueling stations associated with production and storage units to cover the hydrogen needs of road (cars, buses, coaches, trucks), maritime and rail transport.

The French government aims to increase manufacture of electrolysis systems, tanks, fuel cells and related components essential to produce hydrogen from water. The country also wants to install 6.5 GW of hydrogen production capacity from renewable (wind, solar) or nuclear energy.

Not Available (NA)