As of 2024, Greece’s Gross Domestic Product (GDP) stands at over USD250 billion [1]. The services sector remains the largest contributor to the Greek economy, accounting for over 70 per cent of GDP, with tourism as a vital component, attracting millions of visitors each year. Industry and manufacturing contribute around 17 per cent to GDP, while agriculture, although smaller in share, remains important for regional economies.

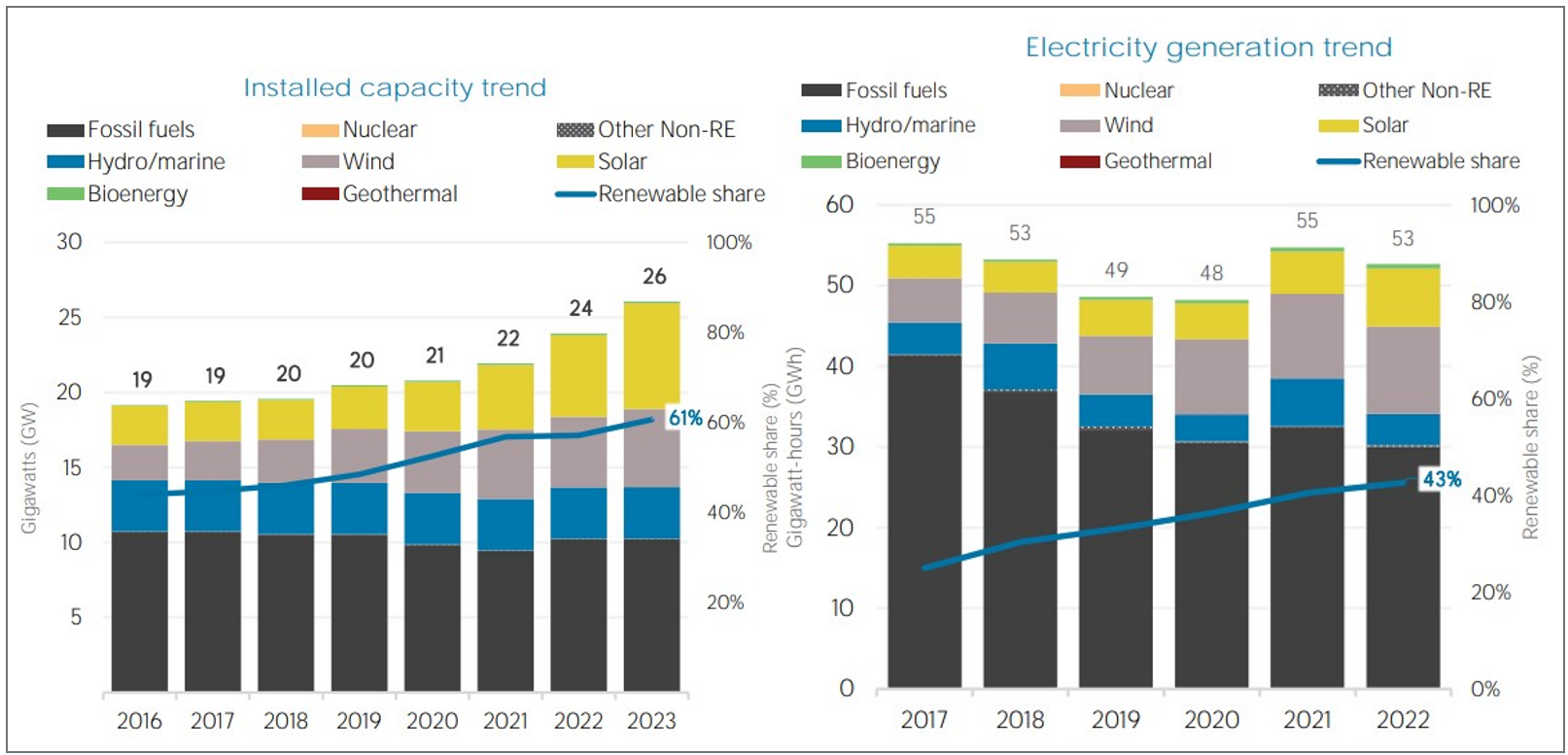

In the past five years, Greece has made remarkable progress in its renewable energy sector. The country’s renewables installed base comprises about 61 per cent of the total of 26 GW installed base as of 2023. Solar PV dominates the renewable installed base with about 7 GW of installed capacity, followed by wind at 5.23 GW and hydro at 3.5 GW. The proportion of renewables in the electricity generation reached about 43 per cent per cent in 2023 (out of an overall 53 GWh electricity generation)[1]. Between 2018 and 2022, the country’s solar energy capacity expanded significantly to over 7 GW. The country aims to double its renewable energy capacity by 2030, which is expected to grow from 14 GW in 2022 to 28GW in 2030.[2]

L-R: Installed capacity trend in Greece; Electricity Generation trend in (Source : IRENA 2024)

Greece is setting bold targets for its energy future, focusing on the development of green hydrogen to meet the demands of the transportation, shipping, and aviation sectors. By 2030, Greece aims to allocate 3GW of renewable energy sources to produce green hydrogen to produce about 0.92 TWh of green hydrogen. Greece aims to position itself as a regional hub for importing green hydrogen from North Africa and the Middle East and exporting it to European countries[1] .

Greece also has the presence of domestic end-use industries like oil refineries which can offtake green hydrogen directly. Some other end-use sectors like transportation are also being targeted for using green hydrogen, subject to technological maturity and cost economics.

Greece's National Hydrogen Strategy outlines a phased approach to integrate hydrogen into its energy mix:

Greece also aims to position itself as a regional hub for importing green hydrogen from North Africa and the Middle East and exporting it to European countries. In line with European Union (EU) requirements, the Greek government intends to establish an institutional framework for hydrogen development by the end of 2024.

To clean up emissions due to natural gas consumption across certain sectors, Greece plans to blend green hydrogen with natural gas. By 2030, the goal is to mix natural gas with green hydrogen to reach a concentration of 5.6 per cent, and this figure is expected to rise to 15.4 per cent by 2050 [1] . To achieve this, authorities are considering imposing mandatory annual minimum requirements on gas suppliers, with these requirements set to increase gradually.

While Greece has not yet implemented a dedicated hydrogen regulatory framework, it is developing regulatory guidelines as part of its hydrogen strategy.

In 2024, Greece's energy landscape was dominated by renewable sources, which constituted the majority of the installed capacity, totaling 26 GW. The leading contributors among renewables were solar and wind energy.

Despite the significant presence of renewables, fossil fuels still played a notable role, accounting for a combined 10 GW of the country's energy generation[1] .

The country benefits from high solar irradiance, making it ideal for photovoltaic (PV) installations. As of 2022, solar energy accounted for approximately 44 per cent of Greece's renewable energy capacity[2] . The country receives a Global Horizontal Irradiance (GHI) ranging from 3.8 – 5.19 kWh/m2 and a Direct Normal Irradiance (DNI) of 3.36 – 5.48 kWh/m2 [3] .

Greece’s National Energy and Climate Plan envisages 7 GW of wind energy in the country by 2030.

Currently Greece has 5.23 GW of wind energy installed, all onshore, covering 21 per cent of its electricity

generation as of 2022

[4]

. There is also a massive technical potential of 423 GW of offshore wind in the country

[5]

.

Advent Technologies has announced plans to manufacture 1 GW/year electrolyser and fuel cell manufacturing facility in Greece. The plant is expected to manufacture the equipment based on High Temperature Proton Exchange Membrane (HT-PEM), which is slated to be more efficient than conventional PEM electrolysers[1] .