India is a middle-income developing economy with notable state participation in strategic sectors. India is fast becoming a global manufacturing destination and has the potential to export goods worth USD 1 trillion by 2030.The country ranks second globally in coal, cement, steel production, food, and agricultural production, third in electricity generation and oil consumption, and fourth in automobile production. Given the economy’s growth potential and the large population, growth in energy demand in India is expected to be significantly higher than all other countries, with demand rising by 3 percent annually (1). Despite the country’s historical dependence on fossil fuels – particularly coal – 60 percent of the growth in energy demand is expected to be met through renewable energy sources owing to the increasing policy push for the sector.

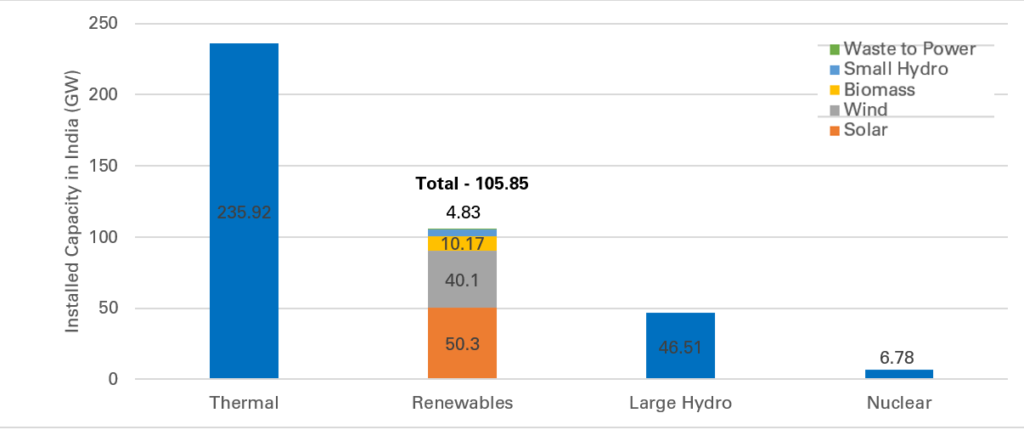

As of 2024, India's installed electricity capacity comprises both fossil fuel and non-fossil fuel sources. The total installed capacity is approximately 417.68 GW. Renewable energy, including large hydro, contributes 41.4% to the total installed capacity. Specifically, solar energy represents 16.1%, wind energy accounts for 10.3%, and other renewable sources make up the remaining percentage.

Sources:

- [Power Sector at a Glance ALL INDIA - Ministry of Power](https://powermin.gov.in)

- [Installed Capacity Report - Central Electricity Authority](https://cea.nic.in)

- [Share of Solar Rises to 13.2% of India’s Total Installed Power Capacity - Mercom India](https://www.mercomindia.com)

Source: Statista

India is aiming for net-zero by 2070. As of February 2023, the total installed power generation capacity in India stood close to 412 GW, of which about 236 GW capacity is based on fossil fuels, while 168 GW of capacity is based on renewable energy sources, including hydro power (2). The country remains strongly committed to this target which can be evidenced from initiatives in the field of renewable energy and biofuel blending. Green Hydrogen is also a priority of the Government of India as this is touted to be the fuel of the future.

Image Credit: Freepik

In FY2023, India's hydrogen demand was approximately 6.1 million tonnes. This is expected to grow at a CAGR of 3.45%, reaching about 8.9 million tonnes by FY2034.

Source: [ChemAnalyst]( https://www.chemanalyst.com )

Hydrogen demand in India for the year 2021 and 2022 is estimated to be 8.5 million tonnes and 9.1 million tonnes, respectively. This demand from the legacy sectors is expected to increase to 11 million tonnes by 2030 (3). The legacy consumers of hydrogen include the ammonia production process in the fertilizer industry and the desulfurization process used in fuel refineries. These two industries currently account for over 80 per cent of the hydrogen consumption, primarily derived using natural gas through steam methane reforming (SMR).

The other major consumer of hydrogen in India is the steel industry based on direct reduction of iron ore (DRI). DRI steel production accounts for around 35 per cent of the total steel produced in India, which is derived from more than 300 DRI steel mills located in various parts of the country. Most of the DRI units in India utilize hydrogen in the form syngas obtained from coal gasification. The large dependence on coal is due to the relatively good availability and low pricing of Indian coal compared to natural gas.

National Green Hydrogen Mission

“To make India the Global Hub for production, usage and export of Green Hydrogen and its derivatives. This will contribute to India’s aim to become Aatmanirbhar through clean energy and serve as an inspiration for the global Clean Energy Transition. The Mission will lead to significant decarbonisation of the economy, reduced dependence on fossil fuel imports, and enable India to assume technology and market leadership in Green Hydrogen.”

Exports: Mission will facilitate export opportunities through supportive policies and strategic partnerships.

Domestic Demand: The Government of India will specify a minimum share of consumption of green hydrogen or its derivative products such as green ammonia, green methanol etc. by designated consumers as energy or feedstock. The year wise trajectory of such minimum share of consumption will be decided by the Empowered Group (EG).

Competitive Bidding: Demand aggregation and procurement of green hydrogen and green ammonia through the competitive bidding route will be undertaken.

Certification framework: MNRE will also develop a suitable regulatory framework for certification of Green Hydrogen and its derivatives as having been produced from RE sources.

In the initial stage, two distinct financial incentive mechanisms proposed with an outlay of ₹ 17,490 crore up to 2029-30:

Depending upon the markets and technology development, specific incentive schemes and programmes will continue to evolve as the Mission progresses.

To ensure quality and performance of equipment, the eligibility criteria for participation in competitive bidding for procurement of Green Hydrogen and its derivatives will specify that the project must utilize equipment approved by Government of India as per specified quality and performance criteria.

Other target areas include: decentralized energy applications, hydrogen production from biomass, hydrogen storage technologies, etc.

The Mission will identify and develop regions capable of supporting large scale production and/or utilization of Hydrogen as Green Hydrogen Hubs.

Development of necessary infrastructure for such hubs will be supported under the Mission.

It is planned to set up at least two such Green Hydrogen hubs in the initial phase.

Outlay of ₹ 400 crore up to 2025-26 for Hubs and other projects.

To facilitate delivery of RE for Green Hydrogen production, various policy provisions including inter-alia waiver of Interstate transmission charges for renewable energy used for Green Hydrogen production; facilitating renewable energy banking; and time bound grant of Open Access and connectivity, will be extended for Green Hydrogen projects.

The National Green Hydrogen Mission, which aims to accelerate the deployment of Green Hydrogen as a clean energy source, will support the development of supply chains that can efficiently transport and distribute hydrogen. This includes the use of pipelines, tankers, intermediate storage facilities, and last leg distribution networks for export as well as domestic consumption.

The Mission will coordinate the various efforts for regulations and standards development in line with the industry requirements for emerging technologies. Work has commenced on establishing a framework of regulations and standards to facilitate growth of the sector and enable harmonization and engagement with international norms.

A public-private partnership framework for R&D (Strategic Hydrogen Innovation Partnership – SHIP) will be facilitated under the Mission. The framework will entail creation of a dedicated R&D fund, with contributions from Industry and respective Government institutions. These institutions will pool resources to build a comprehensive goal-oriented Research and Innovation programme in collaboration with the private sector.

A coordinated skill development programme, that covers requirements in various segments, will be undertaken in coordination with the Ministry of Skill Development & Entrepreneurship.

In addition to the above, the Mission will also cover Public Awareness, Stakeholder Outreach and International Cooperation.

An Empowered Group (EG) chaired by the Cabinet Secretary and comprising Secretaries of Government of India and experts from the industry will guide the Mission; an Advisory Group chaired by the PSA and comprising experts will advise the EG on scientific and technology matters; and a Mission Secretariat headquartered in MNRE will undertake the programme implementation.

The initial outlay for the Mission will be ₹ 19,744 crore, including an outlay of ₹ 17,490 crore for the SIGHT programme, ₹ 1,466 crore for pilot projects, ₹ 400 crore for R&D, and ₹ 388 crore towards other Mission components.

For detailed information on National Green Hydrogen Mission - Click Here .

Government issues Pilot Project Guidelines for utilizing Green Hydrogen in Steel Sector. The Government of India has come out with guidelines for undertaking pilot projects for using green hydrogen in the steel sector. The guidelines, named “Scheme Guidelines for implementation of Pilot projects for use of Green Hydrogen in the Steel Sector under the National Green Hydrogen Mission”, have been issued by the Ministry of New & Renewable Energy (MNRE) on 2 nd February, 2024.

Under the National Green Hydrogen Mission, along with other initiatives, MNRE will implement pilot projects in the Steel Sector, for replacing fossil fuels and fossil fuel-based feedstock with Green Hydrogen and its derivatives. These pilot projects will be implemented through the Ministry of Steel and the Implementing Agencies nominated under this Scheme.

Three areas have been identified as thrust areas for the pilot projects in the steel sector. These are use of Hydrogen in Direct Reduced Ironmaking process; use of Hydrogen in Blast Furnace; and substitution of fossil fuels with Green Hydrogen in a gradual manner. The scheme will also support pilot projects involving any other innovative use of hydrogen for reducing carbon emissions in iron and steel production.

The scheme envisages that considering the higher costs of green hydrogen at present, steel plants could begin by blending a small percentage of green hydrogen in their processes, and increasing the blending proportion progressively, with improvement in cost-economics and advancement of technology. The guidelines also note that upcoming steel plants should be capable of operating with green hydrogen, thus ensuring that these plants are able to participate in future global low-carbon steel markets. The scheme will also consider greenfield projects aiming at 100% green steel.

The use of Green Hydrogen and its derivatives in the steel sector, through the proposed pilot projects, will lead to the development of necessary infrastructure for use of Green Hydrogen in the Iron & Steel industry, resulting in establishment of a Green Hydrogen ecosystem in the steel sector. The utilization of green hydrogen in the steel industry is expected to increase over the years, with the expected reduction in its production cost.

The Scheme Guidelines can be accessed here .

In a significant move for the progress of the National Green Hydrogen Mission , the government has notified the Green Hydrogen Standard for India. The standard issued by the Ministry of New and Renewable Energy (MNRE), Government of India outlines the emission thresholds that must be met in order for hydrogen produced to be classified as ‘Green’, i.e., from renewable sources. The scope of the definition encompasses both electrolysis-based and biomass-based hydrogen production methods.

After discussions with multiple stakeholders, the Ministry of New & Renewable Energy has decided to define Green Hydrogen as having a well-to-gate emission (i.e., including water treatment, electrolysis, gas purification, drying and compression of hydrogen) of not more than 2 kg CO 2 equivalent / kg H 2 .

The notification specifies that a detailed methodology for measurement, reporting, monitoring, on-site verification, and certification of green hydrogen and its derivatives shall be specified by the Ministry of New & Renewable Energy.

The notification also specifies that the Bureau of Energy Efficiency (BEE), Ministry of Power shall be the Nodal Authority for accreditation of agencies for the monitoring, verification and certification for Green Hydrogen production projects.

The notification of the Green Hydrogen Standard for India can be accessed here.

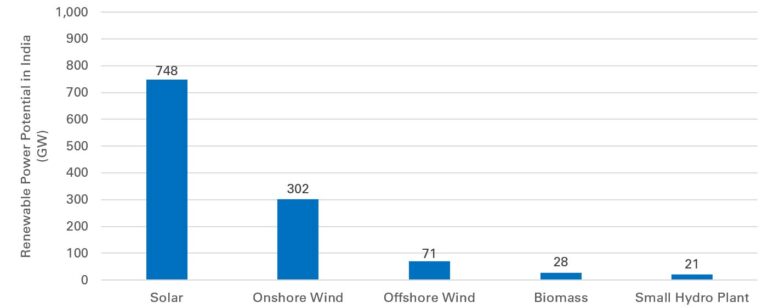

India ranks fourth globally in total renewable energy installed capacity (including Large Hydro), fourth in wind power capacity & fourth in solar power capacity (4) . India’s installed renewable energy capacity has increased 396 per cent since 2014 and makes up about 42.5 percent of the country’s total power generation capacity. This rapid growth in India’s renewable energy sector justifies its rank as the third most attractive global destination for renewable energy investment (5). Solar energy potential in India is more-or-less uniformly distributed across the geographical span of the country, with pockets of slightly higher solar irradiation concentrated in the western region of the country and certain parts in the northern mountainous regions of the country. As a result, solar PV plants located in most parts of the country yield more than 4 kWh per kWp on an average sunny day. The climatic conditions in most parts of the country receiving more than 300 sunny days every year also contribute to the high levels of solar energy potential in the country. The National Institute of Solar Energy has assessed the country’s solar potential of about 748 GW assuming around 3 percent of the wasteland area will be covered by solar PV modules.

The Green Hydrogen Mission identifies various infrastructure initiatives for development of green hydrogen ecosystem in the country. The Mission proposes to identify and develop regions capable of supporting large scale production or utilization of hydrogen as Green Hydrogen Hubs (with trunk infrastructure allowing for pooling of resources and achievement of scale). Green hydrogen mobility corridors will be set up by setting up refueling infrastructure and hydrogen supply arrangements to connect the proposed Hubs. Additionally, infrastructure at major ports is expected to be developed as Green Hydrogen Hubs would be attracted to coastal zones in the vicinity of such ports.

Many global and Indian companies plan to have an installed electrolyser manufacturing capacity of 13-14 GW/yr.

| Consortium or Individual Company | Planned Electrolyser Mfg. Capacity (GW/yr) |

|---|---|

| Adani – Cavendish (5) | 5.0 |

| Reliance – Stiesdal (6) | 2.5 |

| Ohmium (7) | 2.0 |

| Greenko – John Cockerill (8) | 2.0 |

| H2E (9) | 1.20 |

| L&T – Hydrogen Pro (10) | 1.0 |

| Greenzo (11) | 0.25 |

Provisions of India’s National Hydrogen Mission, combined with enabling factors present in the country ranging from a vast renewable energy resource base, large demand potential and the availability of infrastructure has gained the attention of various corporate entities in the country. Companies from both the private and the public sector in India have announced plans for investing in the emerging green hydrogen sector in and scaling it up in the long term. Some of the notable investment announcements include: