India is a middle-income developing economy with notable state participation in strategic sectors. The country has demonstrated remarkable economic growth and is projected to reach a GDP size of USD 7.3 trillion by 2030, as per a Press Information Bureau (PIB) release dated 28 November 2025. India ranks second globally in coal, cement, steel, food and agricultural production; third in electricity generation and oil consumption; and fourth in automobile manufacturing.

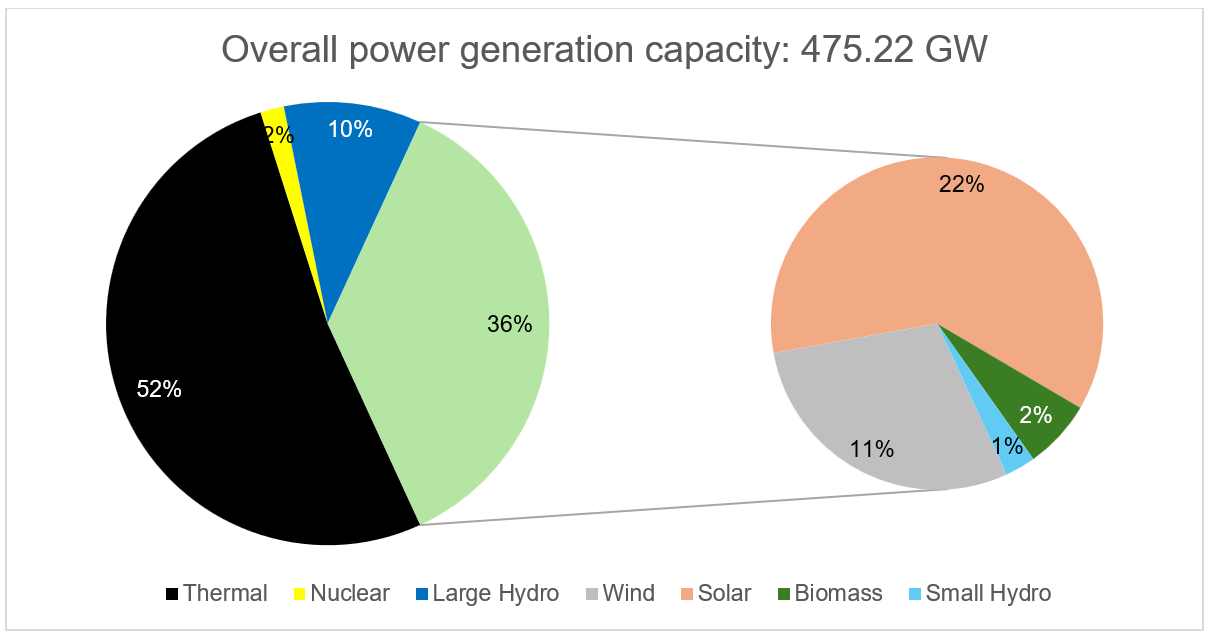

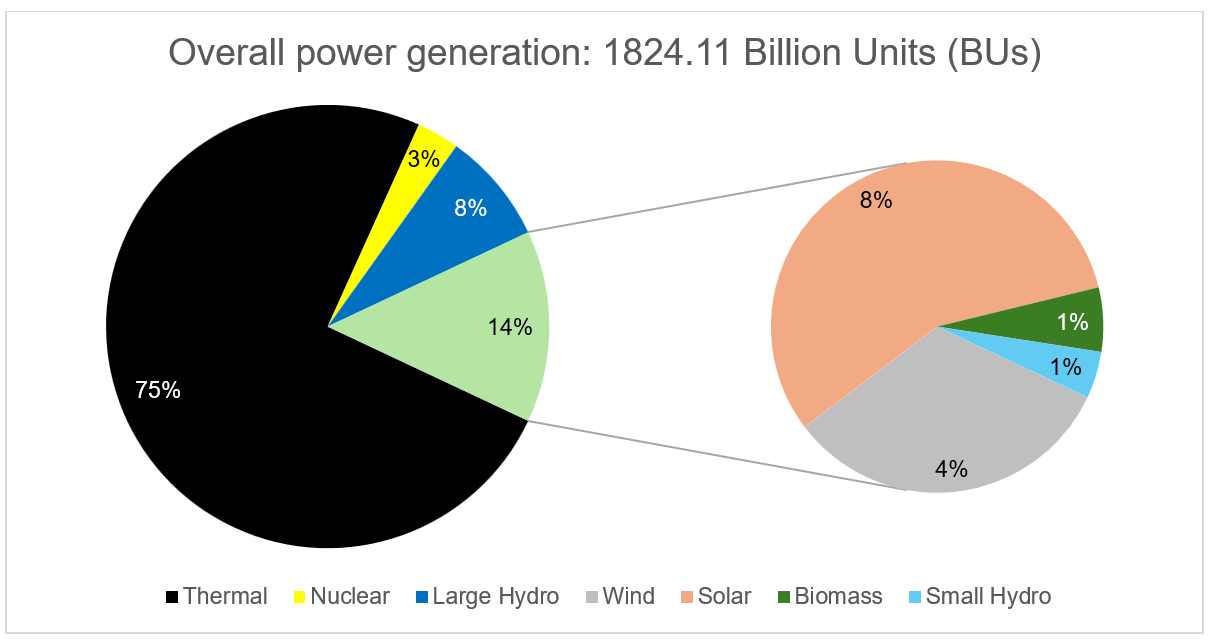

Significant progress has been achieved in expanding overall power generation capacity, particularly in renewables. According to the Renewable Energy Statistics 2024–2025 report by the Ministry of New and Renewable Energy (MNRE), India has witnessed a 72.18 per cent increase in power generation capacity over the past decade, reaching nearly 475.21 GW. Of this, renewables—such as solar PV, onshore wind, hydro, and biomass—contribute approximately 46.32 per cent. However, in terms of electricity generation, renewables accounted for only 22 per cent of total generation as of March 2025, out of an overall 1,824.11 billion units in FY 2024–2025. Within this, variable renewable sources like solar and wind contributed just 12 per cent, despite representing 33 per cent of installed capacity (including large hydro under renewables). The breakdown is illustrated in Figures 1 and 2.

Figure 1 : Breakup of overall power generation capacity in India as of March 2025

Figure 2 : Breakup of overall power generation in India as of March 2025

To read a deep dive report of India, click here.

As per IEA’s Global Hydrogen Review 2025 , India’s hydrogen demand stands at around 10 MMTPA as of 2024, accounting for nearly 10 per cent of global demand. [1] India registered a 4 per cent year-on-year growth, driven by increased consumption in oil refining, chemicals, and steel sectors. [2] However, almost the entire demand continues to be met through fossil fuel-based sources.

The hydrogen demand is almost evenly split between oil refining and fertiliser sectors, with marginal contributions from chemical production (such as methanol) and steel (annealing).

National Green Hydrogen Mission

Overarching Objective

To make India the Global Hub for production, usage and export of Green Hydrogen and its derivatives. This will contribute to India’s aim to become Aatmanirbhar through clean energy and serve as an inspiration for the global Clean Energy Transition. The Mission will lead to significant decarbonisation of the economy, reduced dependence on fossil fuel imports, and enable India to assume technology and market leadership in Green Hydrogen.

Demand Creation

Exports: Mission will facilitate export opportunities through supportive policies and strategic partnerships.

Domestic Demand: The Government of India will specify a minimum share of consumption of green hydrogen or its derivative products such as green ammonia, green methanol etc. by designated consumers as energy or feedstock. The year wise trajectory of such minimum share of consumption will be decided by the Empowered Group (EG).

Competitive Bidding: Demand aggregation and procurement of green hydrogen and green ammonia through the competitive bidding route will be undertaken.

Certification framework: MNRE will also develop a suitable regulatory framework for certification of Green Hydrogen and its derivatives as having been produced from RE sources.

In a significant move for the progress of the National Green Hydrogen Mission , the government has notified the Green Hydrogen Standard for India. The standard issued by the Ministry of New and Renewable Energy (MNRE), Government of India outlines the emission thresholds that must be met in order for hydrogen produced to be classified as ‘Green’, i.e., from renewable sources. The scope of the definition encompasses both electrolysis-based and biomass-based hydrogen production methods.

After discussions with multiple stakeholders, the Ministry of New & Renewable Energy has decided to define Green Hydrogen as having a well-to-gate emission (i.e., including water treatment, electrolysis, gas purification, drying and compression of hydrogen) of not more than 2 kg CO 2 equivalent / kg H 2 .

According to the Renewable Energy Statistics 2024–2025 report by MNRE, India possesses substantial renewable energy potential in solar, onshore wind, biomass, and hydropower. In addition, the country has significant prospects for offshore wind development. Geothermal resources are also available, primarily concentrated along the Himalayan belt, the Cambay Basin in Gujarat, and the Andaman & Nicobar Islands. However, both offshore wind and geothermal energy remain largely untapped.

Table 1 below shows the potential and installed capacity of renewable energy in India [1] , [2] , [3] .

Energy Source | Installed Capacity (as of March 2025) in GW | Potential in GW |

Solar (ground mounted) | 105.6 | 3,343.4 |

Onshore wind | 50.0 | 1,163.8 |

Offshore wind | - | 174 |

Large Hydro | 47.7 | 133.4 |

Small Hydro | 11.6 | 211.3 |

Biomass | 5.1 | 298.5 |

Geothermal | - | 10.6 |

Table 1 : Installed Capacity and Potential of various renewable energy sources in India

A- Existing capacity

At present, India has electrolyser manufacturing capacity of nearly 2 GW/yr, contributed wholly by Ohmium, a US based PEM electrolyser manufacturer. [1] The factory was launched near Bengaluru in July 2024. The factory is expandable to a capacity of 4 GW/yr.

B- Planned capacity

It is estimated that India might have an electrolyser manufacturing capacity of 15-17 GW/yr by 2030 basis announcements. Some of the announcements are mentioned in Table 2 below. Please note that these capacities are independent of SIGHT scheme under NGHM. The offtakers of these electrolysers are also unclear at present.

1. SJVN: India’s first multi-purpose Green Hydrogen pilot at 1500 MW NJHPS, Shimla.

2. Ohmium & Tata Projects: Partnership for green hydrogen EPC; Ohmium to supply PEM electrolyzers.

3. Acme Group: ₹52,470 crore for 1.5 GW green hydrogen/ammonia complex in Tamil Nadu.

4. ReNew & JERA: Green ammonia project in Odisha; 500 MW RE, 100,000 tpa by 2030.

5. CME & IHI: Offtake deal for green ammonia from Odisha to Japan; 1.2 MMTPA by 2027.

6. Acme: World’s first integrated green Hydrogen & NH ₃ pilot in Rajasthan; 5 MWp solar.

7. Acme & Karnataka Govt: ₹52,000 crore for 1.2 MTPA green H 2 /NH 3 project by 2027.

8. NTPC & Gujarat Gas: Green Hydrogen blending in PNG at Kawas using floating solar.

9. OIL: India’s first green Hydrogen pilot (10 kg/day) at Jorhat.

10. Adani & TotalEnergies: USD 50 bn for hydrogen ecosystem; 1 MTPA by 2030.

11. Reliance: Green Hydrogen by 2025; cost

12. ONGC & Greenko: USD 6.2 bn for green Hydrogen projects, export focus.

13. GAIL: 10 MW green Hydrogen plant at Vijaipur (4.3 t/day).

14. HPCL: 24,000 t/year target; 370 t/year plant at Vizag.

15. BPCL: 5 MW electrolyzer for city gas blending.

16. Waaree: 300 MW electrolyzer plant in Gujarat. [1]

17. GreenH: 1 MW PEM electrolyzer in Haryana for hydrogen train. [2]

18. GreenH & Medha: Hydrogen refueling station in Jind for rail project. [3]

19. Plug Power: Plans multi-GW electrolyzer plants in India. [4]

20. 4SECI: Global tender under SIGHT Scheme for electrolyzer manufacturing.

[5]

Read More…