Ivory Coast, located on the southern coast of West Africa along the Gulf of Guinea, features a diverse geography that includes coastal lagoons, tropical forests, and savannahs in the north. As of 2023, the population of Ivory Coast was approximately 31,165,654 people[1]. Ivory Coast stands out as one of the fastest growing and most diversified economies in Africa, playing a key role in the economic landscape of West Africa. In 2023, the country's Gross Domestic Product (GDP) was approximately USD78.88 billion, highlighting its strong performance driven by sectors such as agriculture, mining, energy, services, and manufacturing[2]. The country is the world’s leading producer of cocoa beans, and also exports coffee, cashew nuts, and palm oil. Its mining sector is rich in gold and manganese, while offshore oil and gas contribute significantly to national revenue. This diverse economic base positions Ivory Coast as a regional economic powerhouse in West Africa.

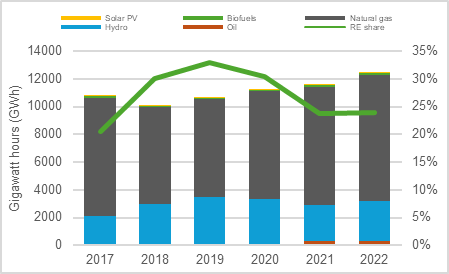

The Ivory Coast has a well-diversified energy mix, with a growing share of renewable energy sources. The country’s domestic energy production is heavily dominated by biofuels and waste, which make up 70 per cent of the total output[3]. In terms of electricity generation, hydro electricity dominates the renewable source which represented 24 per cent contribution to total electricity generation[4].

|

|

Figure: L-R: Domestic energy production in the Ivory Coast; Electricity generation in the Ivory Coast

| |

Ivory Coast currently has limited domestic demand for hydrogen, but it holds significant potential to explore opportunities in the export market [1] . The country presently has a modest presence of iron and steel manufacturing industries and limited facilities for fertiliser production. However, it is endowed with substantial reserves of iron oxides and phosphate, which, when combined with green hydrogen or its derivatives, could support the local production of iron, steel, and fertilisers [2] . Additionally, the transport sector presents a promising avenue for hydrogen-based applications, particularly in urban mobility and logistics. These emerging industries can drive the demand of local hydrogen production in the country.

Ivory Coast currently does not have a dedicated national green hydrogen strategy or roadmap, but it aligns with the broader objectives of the ECOWAS (Economic Community of Western African States) Green Hydrogen Policy and Strategy Framework published in 2023 [1] . The ECOWAS Green Hydrogen Policy and Strategy Framework, aims to position West Africa as a competitive producer and supplier of green hydrogen. The policy supports the integration of green hydrogen into national energy strategies to decarbonise key sectors such as transport, power generation, and industry. Ivory Coast, leveraging its abundant renewable resources, plans to incorporate green hydrogen into its energy mix by 2030, contributing to ECOWAS’s regional target of producing 0.5 million tonnes of green hydrogen annually by 2030.

The regulatory framework governing hydrogen handling, safety, and other critical aspects of the green hydrogen value chain is currently in its formative stages in Ivory Coast. It is anticipated that national regulations are to be shaped significantly by regional initiatives and international best practices.

Ivory Coast has very limited installed capacity for solar and wind energy, reflecting the early stage of development for these technologies in the country. However, it has made significant progress in hydropower, with an installed capacity of approximately 2.5 GW [1] . According to IRENA, in 2023, 95 per cent of the country’s renewable energy capacity comes from hydro and marine sources, while only 5 per cent is contributed by solar energy [2] . This highlights the country’s strong reliance on hydropower and the need to diversify its renewable energy portfolio by scaling up investments in solar and wind infrastructure.

In Ivory Coast, bioenergy derived from biomass and waste, remains the dominant source of sustainable energy consumption, with the household sector accounting for the largest share at 57 per cent, followed by industry 17 per cent [3] . Bioenergy is primarily used for cooking and heating in households, and for steam, heat, and occasional electricity generation in the agro-industrial sector.

The presence of the West African Gas Pipeline—the region’s most extensive natural gas infrastructure—strengthens the foundation for a future hydrogen economy [4] . Additionally, Ivory Coast lies along the proposed 5,600-kilometre transcontinental hydrogen pipeline connecting Morocco and Nigeria. This strategic positioning, spanning 11 countries, presents significant opportunities for future investment, infrastructure development, and policy innovation in the hydrogen sector [5] .

Ivory Coast does not yet have specific manufacturing incentives targeted exclusively at the green hydrogen value chain. However, there are incentives for manufacturing and industrial activities in the renewable energy (RE) sector which includes tax and customs exemptions (VAT, Custom duties) for companies that import, manufacture, or use renewable energy equipment [1] .

As of 2025, Ivory Coast has not yet launched any dedicated green hydrogen projects. However, its strategic location and growing renewable energy sector position it well for future development. The government is focusing on expanding its renewable energy capacity, particularly in solar and biomass, which could support future green hydrogen production.