Namibia has a developing economy, with a Gross Domestic Product (GDP) of USD 12.3 Billion in 2023[1] driven by key sectors such as mining. The country is abundant in mineral resources, including diamonds, uranium, copper, zinc, lithium, and rare earth elements. The mining industry contributes 10 per cent to the GDP, with Namibia heavily reliant on international trade, exporting nearly all its primary resources.

The climate is predominantly hot and dry, with 92 per cent of its land classified as very arid, arid, or semi-arid. While these conditions the country positions itself as one of the top countries globally for solar and wind energy potential.[2] Namibia aims to reduce its projected national emissions by 7.669 Mt CO2e by 2030. The country has also established renewable energy targets, with the objective of generating at least 96 per cent of its electricity from renewable sources by 2030.[3]

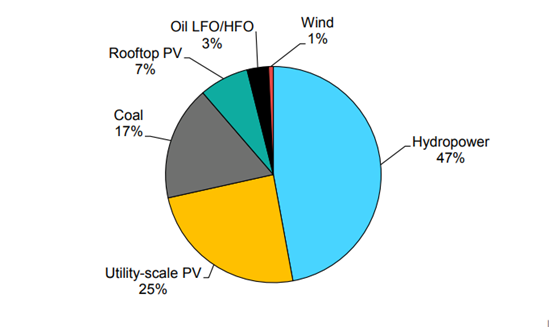

Figure 1: Installed domestic electricity capacity in Namibia by source, 2022 (IEA, 2024)

By the close of 2022, Namibia's installed generation capacity reached 750 MW. Hydropower was the leading source, contributing 347 MW, followed by utility-scale solar PV at 171 MW. Coal accounted for 120 MW, while light/heavy fuel oil added 23 MW. Rooftop solar PV contributed 52 MW, and wind energy provided 5 MW.[4](Refer Figure 1)

Namibia is rapidly positioning itself as a leading nation in the production of competitively priced green hydrogen, leveraging its abundant solar and wind resources. Projections indicate that by 2030, Namibia could achieve some of the lowest green hydrogen production costs globally, second only to Chile. [5]The Namibian government has strategically prioritized green hydrogen and its derivatives as key drivers for economic growth and global decarbonization efforts.[6]

Namibia’s green hydrogen strategy primarily targets international markets, with a focus on exporting to regions such as Europe, Japan, South Korea, and China, driven by their ambitious decarbonization goals. The domestic demand for green hydrogen in Namibia is currently limited due to its modest industrial base. However, projections indicate potential growth in domestic consumption, particularly in sectors like mining and transportation. [1]

Domestic Demand Projections [2] :

In 2022, Namibia bolstered its green hydrogen ambitions by entering into a strategic partnership with the European Union (EU). This collaboration, formalized through a Memorandum of Understanding (MoU), aims to advance Namibia's green hydrogen sector, supporting the country's goal of becoming a leader in the green hydrogen market while aiding the EU in diversifying its energy sources and meeting its climate commitments. [3]

In November 2022, the Government of the Republic of Namibia (GRN) released the Namibia Green Hydrogen and Derivatives Strategy. This strategy, implemented by the Southern African Science Service Center for Climate Change and Adaptive Land Management (SASSCAL) and funded by the German Federal Ministry of Education and Research (BMBF), outlines Namibia's ambitious plans for green hydrogen production.

Key points from the strategy include [1] :

Hydrogen Valleys: Development of three hydrogen valleys to capitalize on high renewable energy potential.

A key component of Namibia's green hydrogen strategy is the proposed Synthetic Fuels Act. This legislation will establish standards for hydrogen production, environmental safeguards, and land-use regulations. Additionally, the government has created the Implementation Authority Office (IAO) to act as a central hub for investors. The IAO will facilitate efficient permitting, transparent land access, and provide regulatory support to attract international stakeholders. [1]

This strategic shift positions Namibia to meet its own energy needs while also supplying international markets that are pursuing decarbonization. By setting clear standards and providing robust support for investors, Namibia aims to become a significant player in the global green hydrogen market.

he Namibian government has established several new institutions to support its green hydrogen initiatives: [2]

Namibia is endowed with exceptional solar energy resources, receiving over 3,000 hours of sunlight annually and boasting an annual solar irradiation of 2,200 to 2,400 kWh/m² in many regions. This makes Namibia one of the top locations globally for solar energy potential. [1]

Comparative data on annual generation potential per unit of installed photovoltaics (PV) capacity shows that nearly the entire country can generate more than 1.8 MWh/kWp (megawatt hours per kilowatt peak) per unit of installed PV, placing Namibia at the high end of global solar capacity averages. This abundant solar resource positions Namibia as a prime candidate for large-scale solar energy projects and green hydrogen production. [2]

Namibia's coastal regions, particularly near Lüderitz and along the Angolan border, benefit from high, consistent wind speeds, making them ideal for wind farms. Onshore wind turbines in these areas are highly profitable. The combination of excellent wind and solar potential helps mitigate intermittency issues and enhances the full load hours of electrolysers, making renewable energy significantly cheaper than fossil alternatives in Namibia. [3]

Namibia's access to affordable renewable energy enables the production of green hydrogen and its derivatives, such as ammonia and methanol, at competitive prices. This is contingent on investors having access to necessary capital and cost-effective electrolyser technologies. This strategic advantage positions Namibia as a key player in the global green hydrogen market, fostering economic growth and supporting international decarbonization efforts.

Namibia can leverage its renewable energy resources in three key-ways: [4]

Another significant competitive advantage for Namibia is its vast availability of land. With extensive tracts of arid, sparsely populated areas, the country offers ample space for energy projects on government-owned land. The Namibia Green Hydrogen and Derivatives Strategy highlights the importance of state-owned land in the development of green hydrogen. [5]

[2] International Renewable Energy Agency (IRENA, 2023)

[3] PowerPoint Presentation – ISA Readiness Assessment of Green Hydrogen in African Countries, 2024

The Green Hydrogen and Derivatives Strategy outlines the creation of three hydrogen valleys in Namibia. These valleys will be strategically situated in the southern Kharas region, the central area that includes the port of Walvis Bay and the capital city, Windhoek, and the northern Kunene region. These hydrogen valleys are envisioned as key centers for the advancement and implementation of green hydrogen projects, fostering economic development and supporting Namibia's transition to green energy. [1]

Namibia has achieved a significant milestone in its green hydrogen journey. On March 12, 2025, the HyIron Oshivela plant successfully produced southern Africa's first green hydrogen using a 12MW electrolyser from China's Peric Hydrogen System. This electrolyser, the largest operational one in southern Africa, is integrated into a smart microgrid powered entirely by renewable energ, including a 25MW solar farm and a 13.4MW battery system. [1]

Figure 1: Map with planned green hydrogen and derivatives projects in Namibia (Green Hydrogen Production in Namibia - GreeN-H2 Namibia Report)

The Oshivela plant's initial production capacity is 5 tonnes of green iron per hour, with an annual target of 15,000 tonnes of Direct Reduced Iron (DRI). This project underscores Namibia's commitment to green industrialization and positions the country as a key player in the global green hydrogen market. [2]

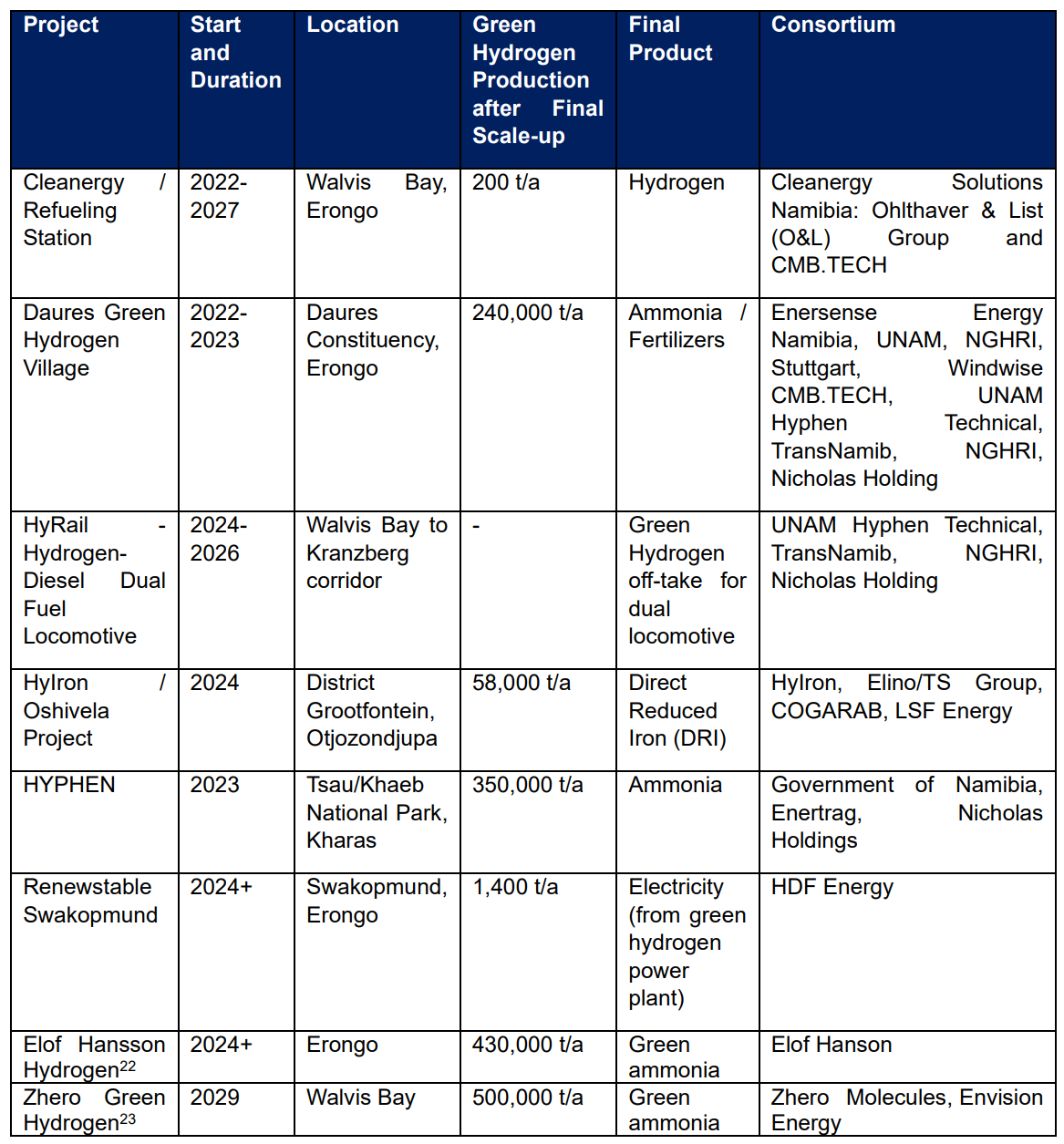

Major Green Hydrogen Projects in Namibia [3] :

For detailed insights on Namibia Green Hydrogen, refer to Readiness Assessment of Green Hydrogen in African Countries, 2024 .