Russia is a major player in global energy markets. It is one of theworld's top three crude producers, competing for the top place with Saudi Arabia and the United States. It relies heavily on revenues fromoil and natural gas, which in 2021 made up 45 Percent of Russia’s federal budget.[1]Russia is the world's second-largest producer of natural gas, behind the United States, and has the world's largest gas reserves. It is the world's largest gas exporter. In 2021 the country produced 762 bcm of natural gas and exported approximately 210 bcm via pipeline.

Furthermore, It has been expanding its liquefied natural gas (LNG) capacity, to compete with growing LNG exports from the United States, Australia and Qatar.

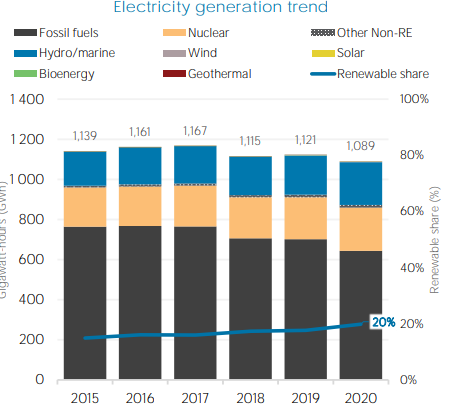

Power plants in Russia had a total installed capacity of 247.6 GW as of January 1, 2023, marking an increase from the previous year.[2] Thermal power plants accounted for nearly two thirds of the total electricity generation capacity. Russia is rich not only in oil, gas and coal, but also in wind, hydro, geothermal, biomass and solar energy - the resources of renewable energy. However, fossil fuels dominate Russia's current energy mix, while its abundant and diverse renewable energy resources play little role. It total energy capacity from renewable sources reached 56.1 GW in 2021, continuously increasing over the past decade

Russia's primary goal is to become a world-leading producer and exporter of hydrogen energy. Its official goals are to export 0.2 million metric tons by 2024 and 2 million by 2035. Russia plans to leverage its large natural gas reserves, existing infrastructure, and cooperation with foreign partners to take a major stake in the global hydrogen market. Targeting 20% of market share by 2030, Russia is set to ramp up production over the next five years. Studies indicate that Russian hydrogen production was at 3.4 million mt in ammonia and 2.7 million mt in refining in 2021. It expects these volumes to increase to 3.8 million mt and 3.1 million mt, respectively, by 2025.

Russia's pilot hydrogen projects already in the pipeline might produce 15.7 million metric tons per year by 2033, exceeding the country's ambitious 2035 target set in a concept document in August, according to data from the industry and trade ministry. It is estimated that hydrogen production in Russia and the development of hydrogen technologies will be intended principally for export. Potential export volumes could amount to 0.2 million tonnes in 2024, from 2-12 million tonnes in 2035 and 15-50 million tonnes in 2050, depending on how quickly world low-carbon economies develop and a rise in demand for hydrogen on world markets

Russia's pilot hydrogen projects already in the pipeline might produce 15.7 million metric tons per year by 2033, exceeding the country's ambitious 2035 target set in a concept document in August, according to data from the industry and trade ministry. It is estimated that hydrogen production in Russia and the development of hydrogen technologies will be intended principally for export. Potential export volumes could amount to 0.2 million tonnes in 2024, from 2-12 million tonnes in 2035 and 15-50 million tonnes in 2050, depending on how quickly world low-carbon economies develop and a rise in demand for hydrogen on world markets.

Russia's primary goal is to become a world-leading producer and exporter of hydrogen energy. Its official goals are to export 0.2 million metric tons by 2024 and 2 million by 2035. The government has approved its overall concepts for developing hydrogen energy in Russia, which call for the creation of a hi-tech export-oriented sector with an annual export volume of up to 50 million tonnes of hydrogen by 2050. The Russian Federation's strategic goal for the development of hydrogen energy is to make the country one of the leading producers and exporters of this energy carrier.

At the end of 2019, work began on the Russian Federation's national strategy for hydrogen energy (it is still unclear when it will be formally adopted). One of the first results of this work is the Concept for the development of hydrogen energy in Russia, which has just been approved. Among other things, the document highlights a projected increase in demand for hydrogen in the EU and Asian countries, which Russian production could meet to a great degree.

The concept adopted assumes the development of hydrogen energy in Russia over three phases.

Not Available

Russia plans to leverage its large natural gas reserves, existing infrastructure, and cooperation with foreign partners to take a major stake in the global hydrogen market. One of the positives of Russia's power generation capacity is its low carbon footprint. The power generation sector is dominated by gas-fired heat and power stations, which account for 48% of the total power generation capacity, followed by nuclear power stations 18% and hydroelectric power stations 17%. This energy production mix works for Russia's hydrogen future. Given its vast water resources and its potential for generating wind energy, Russia can produce large amounts of green hydrogen to meet the future demands of energy markets. In addition, it is also among the world's top producers of nuclear energy with 38 operational nuclear plants, which can further contribute to producing low carbon hydrogen.

Russia has several advantages for the development of hydrogen energy. These include:

Russia intends to use its advanced gas transportation infrastructure and its longstanding hydrogen production history (for military and space exploration purposes) to its advantage. It leads in its resource base and scientific background in hydrogen production, transportation, and storage. This includes possible special investment in territories that are adaptable for hydrogen production, as well as relevantequipment manufacturingand R&D.

Not Available

Russia and Germany have signed a deal on potential cooperation on sustainable energy, including hydrogen. Officials from western companies with long-standing involvement in the Russian energy sector have also expressed interest in joining hydrogen projects in Russia, including BP and TotalEnergies. Meanwhile, Japan has announced that it will work with Russia's Rosneft and Novatek on lower carbon projects, including hydrogen and ammonia, as well as CCS.

Companies planning to implement hydrogen projects include Rosatom, Rusnano, Lukoil, En+ Group, Tatenergo, H4Energy, Gazprom Energoholding, Novatek , Energy Fund, North Star, SUEK, AFK Sistema and others. Europe’s biggest utility Enel is looking to develop a green hydrogen project in Russia as part of plans to expand its renewable energy business in the country.

There is a successful demonstration project, the hydrogen-powered tram in St. Petersburg developed by the Krylov State Research Centre in 2020. InEnergy is partnering with Russia's truckmaking giant, KAMAZ, to develop hydrogen bus prototypes. KAMAZ, which already produces lithium-ion electric buses, has included hydrogen-powered buses and trucks in itsRD programme for 2021.

Russia's aluminum giant Rusal has introduced ALLOW, its own brand of “green aluminum” with a carbon footprint of less than 4 tons of CO2 per ton. Rusal's “green aluminum” is produced with energy from large Siberian hydropower plants and its demand is expected to grow in the coming years. Another promising example is NLMK, a leading steel producer in Russia, which is cooperating with Air Liquide in developing its hydrogen assets and reducing the carbon footprint of its steel.