Singapore, officially known as the Republic of Singapore, is an island nation in Southeast Asia situated close to the Straits of Malacca, one of the world's busiest maritime trade routes. Its strategic geographic location has established the country as a major global maritime hub. The country boasts a highly developed free-market economy with a strong emphasis on trade, financial services, and manufacturing. In 2022, Singapore's Gross Domestic Product (GDP) reached USD498.47billion [ [1] ]. Value added services in the form of banking, trade, tourism etc. are the largest contributors to the nation's GDP accounting for approximately 71 per cent in 2022 [ [2] ]. The country has committed to reducing emissions to around 60 MtCO2e in 2030, following an earlier peak. Additionally, it aims to achieve net zero emissions by 2050 [ [3] ].

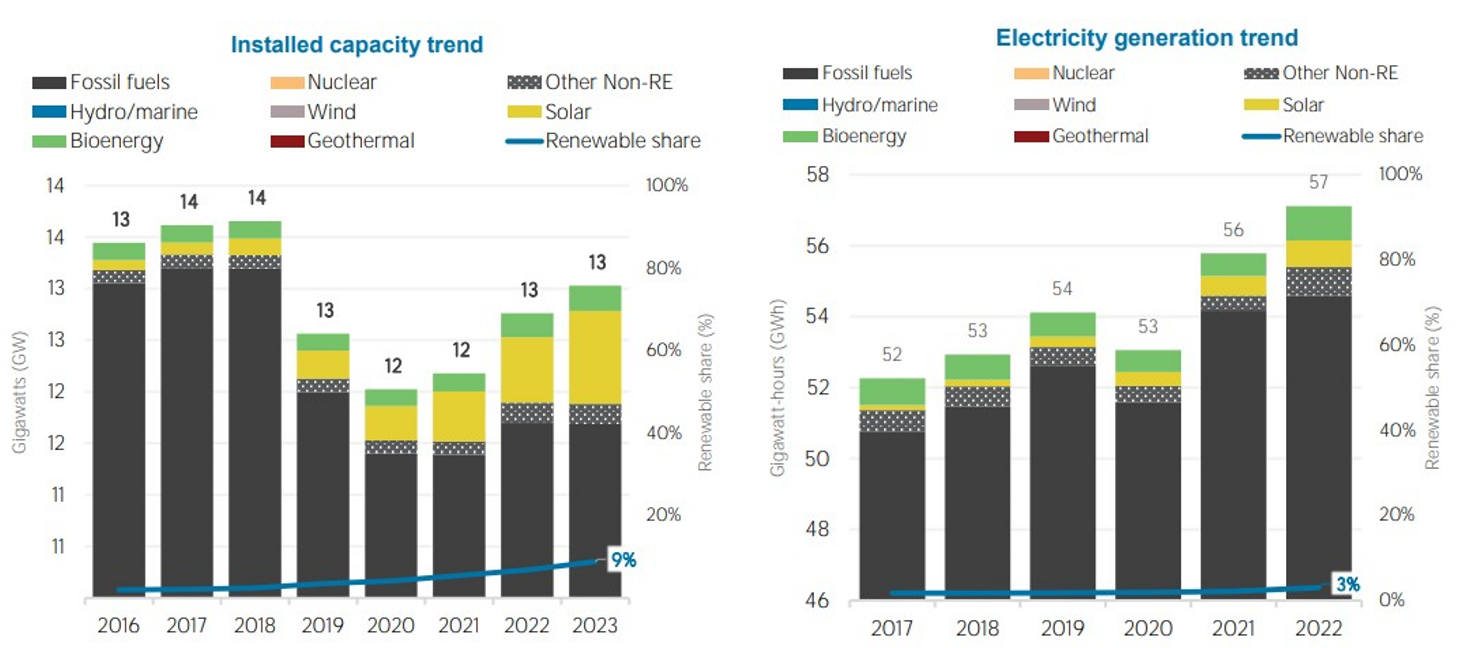

Singapore’s electricity sector is reliant on fossil fuels, particularly natural gas. As of 2023, Singapore had approximately 13 GW of installed electricity generation capacity, with around 88 per cent powered by natural gas alone [ [4] ]. Renewable energy sources account for only 8.8 per cent of the power generation capacity, primarily comprising of solar PV (approximately 900 MW) and bioenergy (approximately 246 MW).

Fig: L-R: Installed capacity trend in Singapore; Electricity generation trend ( IRENA 2023 )

Singapore is grappling with rising energy demands and is prioritising enhanced energy efficiency and is also venturing into cleaner sources of energy to meet its emission reduction commitments and decrease its reliance on imported fossil fuels. Consequently, the nation is embracing green hydrogen as an alternative clean energy vector. Green hydrogen and its derivatives like green ammonia are poised to play a pivotal role in diminishing Singapore’s dependence on imported natural gas and decarbonising challenging sectors such as chemicals, power generation, shipping, and aviation. The government aspires for green hydrogen to fulfil up to 50 per cent of Singapore’s power requirements by 2050, aligning with its Net Zero 2050 commitment.

[4] IRENA stats tool, IRENA, July 2024

Hydrogen demand in Singapore is largely anticipated from the industrial sector, particularly refining and chemicals such as ammonia. The country's petrochemical complex, one of the largest globally, is a

significant consumer of hydrogen. However, hydrogen production in Singapore currently relies on fossil fuels (grey hydrogen).

Singapore’s estimated hydrogen demand can be broadly assessed from its existing oil refining capacity and ammonia imports for chemical processes. As a major maritime bunkering hub, Singapore boasts a

well-established oil refining capacity of approximately 1.5 million barrels per day [[1] ]. Oil refining processes use hydrogen to perform crucial processes like desulphurisation, hydrocracking etc.

In 2023, Singapore also imported nearly 5.58 kilotons of ammonia [[2] ]. The combined hydrogen demand from refining and ammonia imports is estimated to be approximately 750 KTPA at present. However, as emission regulations become stricter, the demand for hydrogen from hard-to-abate sectors is expected to increase significantly. Consequently, Singapore may witness a surge in green hydrogen demand, not only from its existing refining and chemical sectors but also from emerging sectors such as maritime bunkering, power generation, data centres, and transportation.

In 2022, Singapore unveiled its National Hydrogen Strategy to investigate hydrogen as a cornerstone of its energy transition and net-zero ambitions by 2050. Significant technological advancements will enable Singapore to generate 50 per cent of its power from low-carbon hydrogen by 2050. The strategy outlines:

The strategy also emphasizes the development of international supply chains for green hydrogen and the establishment of Singapore as a hydrogen trading hub in Asia.

Research and Development (R&D): The government has committed SGD55 million (approximately USD40 million) towards hydrogen research as part of the Low-Carbon Energy Research (LCER) initiative

[[1] ].

Hydrogen imports: Singapore is working with partners like Australia to explore green hydrogen imports, which could play a major role in satisfying Singapore’s energy needs by 2040 [[2] ].

While Singapore has not yet implemented a dedicated hydrogen regulatory framework, it is developing regulatory guidelines as part of its National Hydrogen Strategy. Current focus areas include:

The government is also studying best practices from other leading hydrogen economies to create a framework that supports hydrogen market development and infrastructure investment.

The Energy Market Authority (EMA) and the National Climate Change Secretariat (NCCS) are working on hydrogen-related regulations. Ongoing efforts include developing safety regulations for hydrogen production, transportation, and usage. Singapore is also collaborating with international standards organizations (like ISO and IEC) to establish a certification system for green hydrogen.

Singapore is in the initial phases of developing the necessary infrastructure for green hydrogen production, storage, transport and large-scale utilisation. Singapore lacks large-scale hydrogen storage facilities but is investigating options such as underground caverns for storage.

The Jurong Island Petrochemical Hub is a potential site for hydrogen storage and distribution, given its existing gas infrastructure. The government is exploring the feasibility of blending hydrogen into existing natural gas pipelines and establishing hydrogen refuelling stations.

In February 2022, the Civil Aviation Authority of Singapore (CAAS) signed a Cooperation Agreement with Airbus, Changi Airport Group, and Linde to study the development of hydrogen supply and infrastructure for aviation. Under this agreement, the parties will collaborate to conduct market analysis on the projected aviation demand and supply for hydrogen, as well as regional readiness and commercial feasibility for its adoption.

Owing to Singapore’s strategic location as a global maritime hub, the Port of Singapore is being considered as a potential site for bunkering green hydrogen and derivatives like green ammonia for shipping. The Maritime and Port Authority of Singapore (MPA) is exploring the use of hydrogen as a fuel for ships and port operations. The Port of Singapore is currently the world’s busiest container transhipment port, with ship arrival tonnage exceeding 2.8 billion gross tonnes in 2021. Singapore is also the world’s largest bunkering hub, supplying close to 50 million tonnes of marine bunker fuel to vessels on international shipping routes in 2021. As a major global maritime hub, Singapore can play a crucial role in the sector’s decarbonisation, particularly through transitioning to lower-carbon fuels.

Currently, over 95 per cent of Singapore's energy consumption comes from LNG and oil. However, the country has ambitious renewable energy targets, focusing on local solar energy production and importing clean energy from neighbouring countries [[1] ]. Renewables at 867 MW, currently make up about 3 per cent of Singapore's total electricity generation, with solar power being the primary source, as of 2022 Singapore aims to boost its renewable energy capacity to at least 2 GW peak by 2030.

Due to limited land availability, land-intensive

utility based renewable projects, especially solar and onshore wind, have limited installed base.

Solar energy is restricted to mostly rooftop panels with limited installations for utility-scale projects. Investments in solar energy, international energy generation, and regional grids for clean electricity importation are crucial for sustainable growth.