With an income per capita of 4,103 nominal US dollars, Sri Lanka is an upper middle-income nation. The main economic sectors of the country are tourism, tea export, apparel, textile, rice production and other agricultural products. Sri Lanka’s primary energy supply mainly comes from oil and coal. Almost 40% of Sri Lanka’s electricity came from hydropower in 2017 but coal’s shares in power generation has been increasing since 2010 1.

The Sri Lankan government has set a goal of achieving 70 percent renewable energy generation by 2030 and becoming carbon neutral by 2050. As a tropical island on the equator, Sri Lanka is blessed with many renewable energy sources, which is the prime mover of green hydrogen economy. Having only two seasons of monsoonal rains, Sri Lanka is mostly having a dry climate for the rest of the year which maximizes its window to grab full potentials of solar power. Further, as an island nation, onshore and offshore wind potentials are enormous.

The Sri Lankan Government has already started tapping much of these potentials with projects such as Thambapavani wind farm in Mannar. With the increasing global demand for green hydrogen, capturing a significant market share will be an advantage for the country’s economy

Sri Lanka is prioritizing the development of domestic energy resources, with a special emphasis on renewable energy sources, and employing hydrogen as an effective storage medium. Green hydrogen is also being harnessed as a sustainable alternative to fossil fuels in the transportation and industrial heating sectors.

The National Hydrogen Roadmap was launched in September 2023 and was developed in collaboration with the Petroleum Development Authority of Sri Lanka (PADSL) and Greenstat Hydrogen India, a subsidiary of a Norwegian energy company with a focus on green hydrogen.

The roadmap covers various sectors such as energy security, sectoral decarbonization, transport and logistics, manufacturing and agriculture, and buildings and energy. The President of Sri Lanka highlights the importance of green hydrogen in utilizing the country's abundant wind and solar resources for grid-independent export and attracting global capital. The roadmap's objectives include creating an enabling environment, ensuring bankability in green hydrogen projects, establishing infrastructure, promoting international collaboration, and implementing pilot projects.

The Sri Lanka National Hydrogen Roadmap covers several sectors for the implementation of green hydrogen. These sectors include:

The objectives of the Sri Lanka National Hydrogen Roadmap, as inferred from the extracted content, are as follows:

Phased Implementation:

As per the Green Hydrogen Roadmap, Sri Lanka believes that the key to successfully integrating and implementing a hydrogen economy lies in maintaining unwavering safety standards. To achieve these high standards, the country has initiated collaborations with technology partners who possess extensive experience in the most demanding environments related to hydrogen and molecular safety. As a result, Sri Lanka plans to release its Hydrogen Safety Standards, which will comprise a robust monitoring and evaluation framework as well as periodic revisions to keep pace with global advancements in the field. Ensuring that safety standards are not compromised will provide a solid foundation for the growth and success of the hydrogen economy in Sri Lanka. Sri Lanka is also committed to actively participating in the global push towards standardized green hydrogen certification. By engaging in international collaboration and aligning with global best practices, the country can contribute to the development of a transparent and robust certification system. The following points outline how Sri Lanka plans to participate in this effort:

Sri Lanka is endowed with several types of renewable energy resources, including biomass, hydropower, solar and wind. Sri Lanka aspires to become a carbon neutral country by 2050 by making the most out of the energy available and developing cleaner energy resources according to the National Energy Policy and Strategies of Sri Lanka. The country could potentially increase to a capacity of 73GW, that it can use to produce green hydrogen for domestic energy use, while its surplus wind power can be exported.

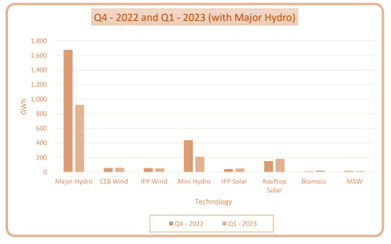

Hydroelectricity is the second highest energy generation source in Sri Lanka after fossil fuels.

As the country is rich in other renewable energy sources such as solar, wind, and biomass, the Sri Lankan government has approved a base case plan which outlines a target of 4,705MW of solar power, 1825MW of wind power, 195MW of mini-hydro, and 200MW of biomass power by 2030. [1]

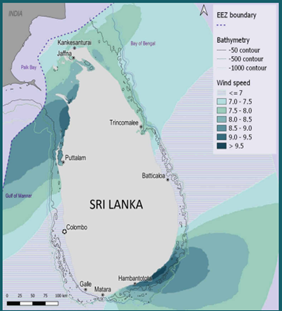

Sri Lanka has the locational potential for estimated 56GW of offshore wind, according to a new report published by the World Bank. Its Offshore Wind Roadmap for Sri Lanka down the potential for 27GW of fixed offshore wind in shallow waters (less than 50 metres) and 29GW of floating offshore wind in deeper waters (between 50 and 1,000 metres). [2]

There are three broad areas suitable for offshore wind development, but the western and southern coasts have the most energetic wind speeds and suitable technical conditions, according to the report, which was commissioned by the country.

Green hydrogen and its derivatives represent the most viable option for maximizing the potential of this excess renewable energy. Furthermore, exporting green ammonia will provide significant economic benefits through lease, royalty, and tax revenues from the allocation and commercialization of acreage for offshore wind. Sri Lanka can move from an energy deficit to a surplus if it develops large volumes of green hydrogen and ammonia within the next five years.

According to the Sri Lanka National Hydrogen Roadmap, initiatives such as the procurement and manufacturing of electrolysers, hydrogen storage systems, and transport systems will be given priority to meet demand and ensure high efficiency and low cost. [1]

Identification of opportunities in hydrogen value chain manufacturing, such as electrolysers and hydrogen storage equipment will be undertaken under Phase 1 of its hydrogen roadmap. The domestic manufacturing of electrolysers and associated equipment shall commence in the Phase 4 of the roadmap i.e., between 2035 and 2048. [2]