The Netherlands, one of the most advanced economies in Europe, plays a pivotal role in global trade, energy, and logistics. In 2023, the country’s Gross Domestic Product (GDP) was approximately over USD1 trillion.[ 1 ] The economy is driven by a mix of agriculture, industry, and a robust services sector, with energy playing a critical role in sustaining industrial activities and trade.

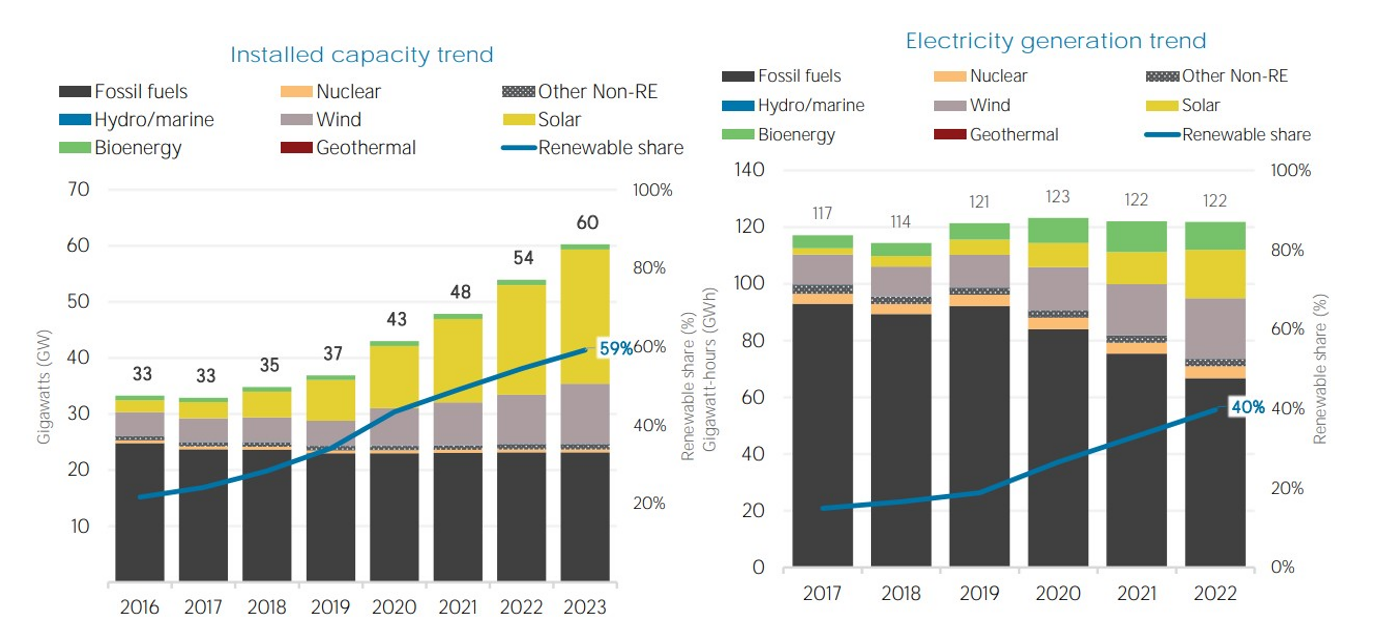

The Netherlands has a well-diversified energy mix, with a growing share of renewable energy sources. As of 2023, natural gas, which has been historically dominant, accounted for about 35 per cent of total energy consumption.[ 2 ] Renewables represented almost 60 per cent of the total installed capacity with a 40 per cent contribution to total electricity generation. Renewables penetration is expected to rise significantly as the country scales up investments in offshore wind and solar energy.[ 3 ]

Figure: L-R: Installed Capacity in Cambodia; Electricity generation in the Netherlands [4]

The Netherlands has established itself as a key player in the global hydrogen economy. With its advanced infrastructure, strategic geographic location, and robust renewable energy capabilities, the country is wellpositioned to lead in green hydrogen production, trade, and consumption.

The Netherlands consumes approximately 8 billion cubic meters (approximately 0.7 MMTPA) of hydrogen annually, which is majorly produced from natural gas [5 ] . The Netherlands is shifting focus toward green hydrogen, powered by renewable energy sources like offshore wind.

The industrial sector is the largest hydrogen consumer in the Netherlands. The Port of Rotterdam and Schiphol Airport are piloting hydrogen as a sustainable fuel alternative.[ 6 ]

The Netherlands aims to become a net exporter of hydrogen, leveraging its position as a key transit country for European energy flows. Partnerships with hydrogen-producing countries like Chile, Morocco, and Australia are under development to establish import-export pathways.

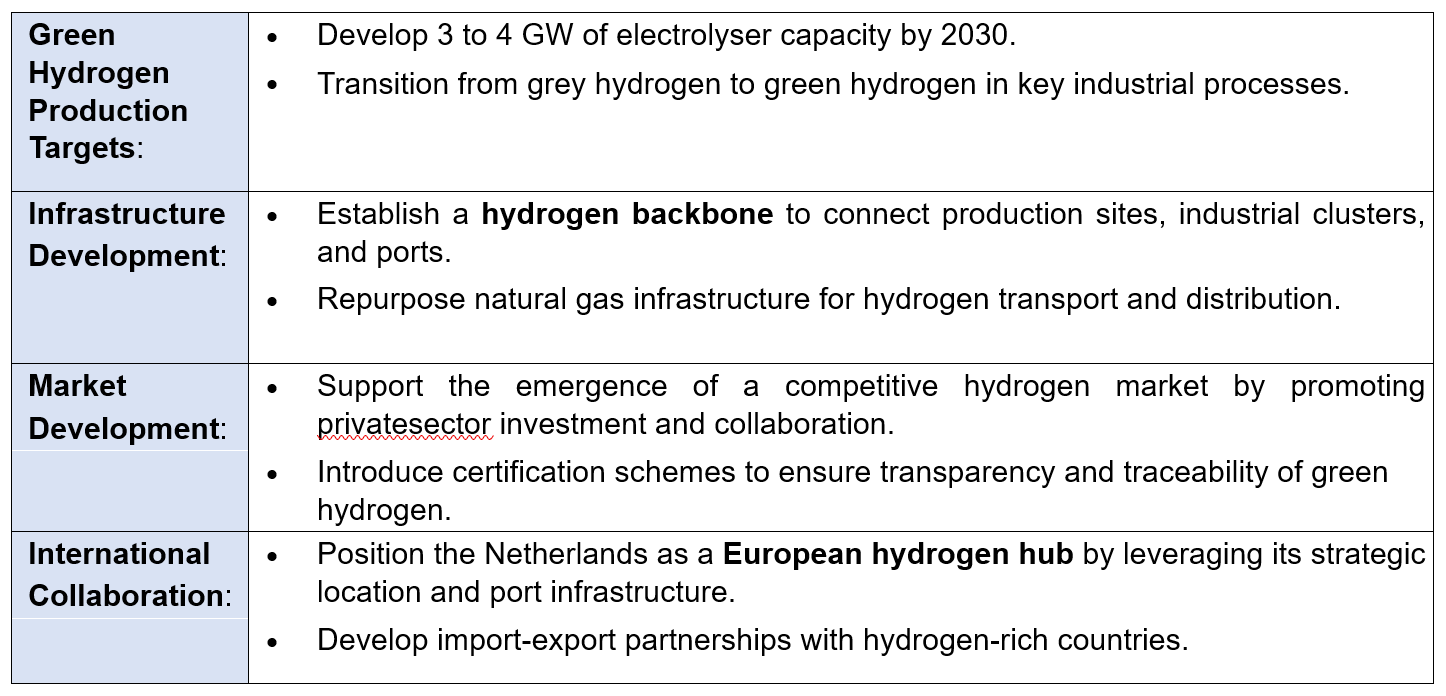

The Netherlands has developed a robust hydrogen policy framework, aligning with its broader climate and energy transition goals. Central to this framework is the government’s National Hydrogen Strategy (2020), which outlines the key steps for developing a sustainable hydrogen economy[1] .

Incentive schemes

In August 2024, the Netherlands introduced the subsidy scheme for large-scale green hydrogen production. This scheme supports companies building hydrogen facilities of at least 0.5MW to produce renewable hydrogen. With a budget of nearly EUR1 billion, it aims to support at least 200 MW of capacity for a maximum period of 10 years. [ 9 ] The scheme has two parts:

The regulations on hydrogen handling, safety and other such aspects related to the green hydrogen value chain are under development in the Netherlands. It is envisaged that the national regulations on green hydrogen will be influenced majorly by the ones drafted by European Union. Some notable developments are the following.

Safety is a top priority in the Netherlands' hydrogen legal framework. In the absence of specific legislation on safety, the Hydrogen Safety Guidelines provide guidance on handling risks and uncertainties. These guidelines outline safety levels, guarantees, responsibilities of authorities, and the role of grid operators. There are three main guidelines: one for general safe handling of hydrogen, one for hydrogen pilots in buildings, and one for handling hydrogen carriers and imports.[ 8 ]

The Netherlands has approximately 4.7 GW of installed offshore wind capacity as of 2023, supplying significant renewable energy for hydrogen production.[ 10 ] The country targets 21 GW of offshore wind capacity by 2030, with a portion dedicated to powering hydrogen electrolysis plants.[ 11 ]

The Netherlands deployed 4.82 GW of new solar capacity in 2023. The country’s cumulative installed PV capacity hit 24.4 GW at the end of December.[ 12 ]

Gasunie is repurposing existing natural gas pipelines to create a hydrogen backbone by 2027, connecting hydrogen production sites with industrial clusters and ports.[ 13 ] Significant investments are being made to upgrade the electricity grid, ensuring seamless integration of offshore wind and solar energy to support green hydrogen projects. The Netherlands has robust electricity and gas interconnections with neighboring countries, enabling cross-border trade of renewable energy and hydrogen.

Battolyser has announced plans to manufacture 1 GW/yr electrolysers in Rotterdam[1] . The plant is slated to be operational by 2026 and will manufacture innovative electrolysers based on nickel-iron batteries.

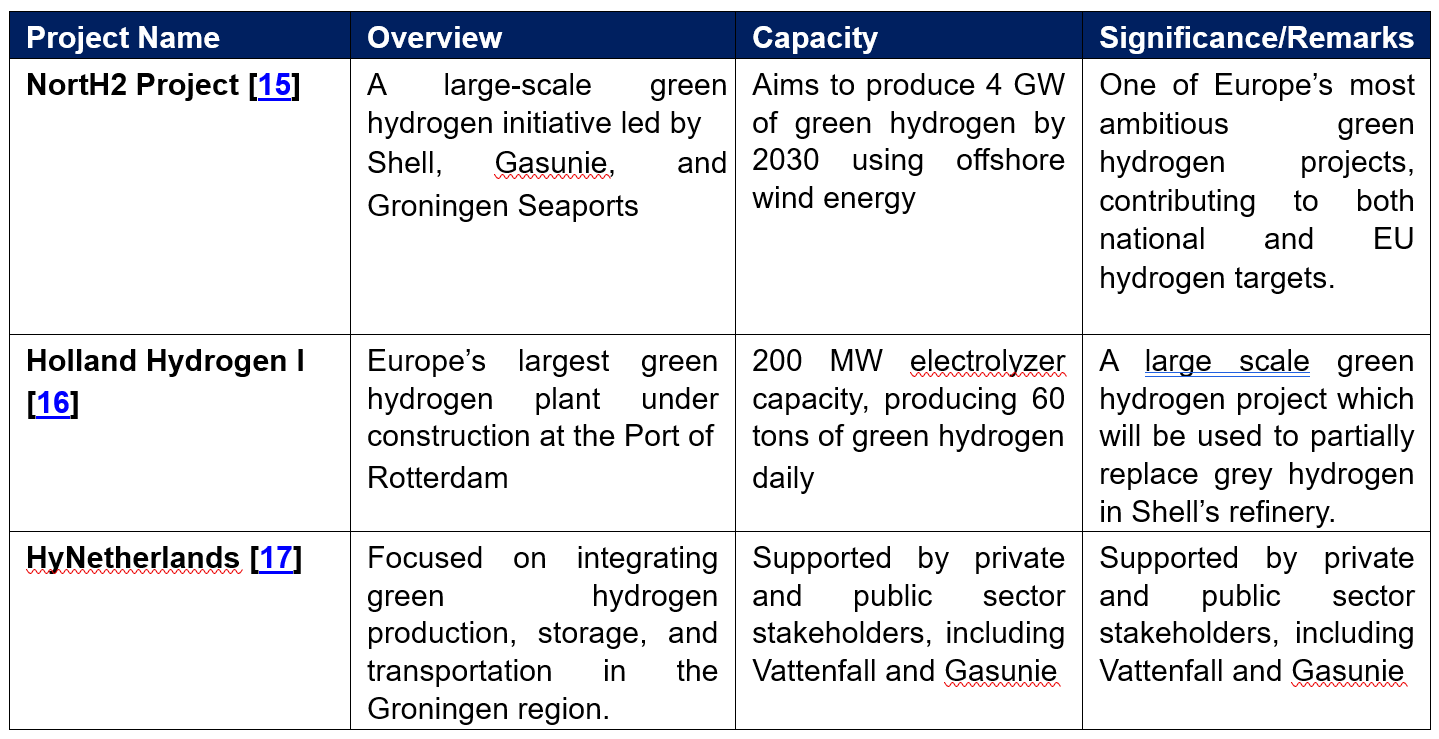

The Netherlands has established itself as a leader in green hydrogen development through various highprofile projects, pilot initiatives, and international partnerships. These efforts are crucial to achieving the country’s decarbonization goals and positioning it as a global hydrogen hub.es. Flagship Green Hydrogen Projects –

Pilot Projects –

Hydrogen Hub:

Rotterdam is being set up as a major hydrogen hub in Europe catering to large-scale green hydrogen trade and production. The hub will ensure the production of GH from offshore wind. Rotterdam has signed green hydrogen / ammonia import agreements with RE-rich regions like Iceland, Portugal, Spain etc. Electrolyser manufacturing facilities are also being developed in the area (eg. Battolyser gigafactory). Rotterdam has also signed a “Green Maritime Corridor” development agreement with Singapore to facilitate the movement of cargo ships running on clean fuels like green ammonia and methanol produced from green hydrogen.