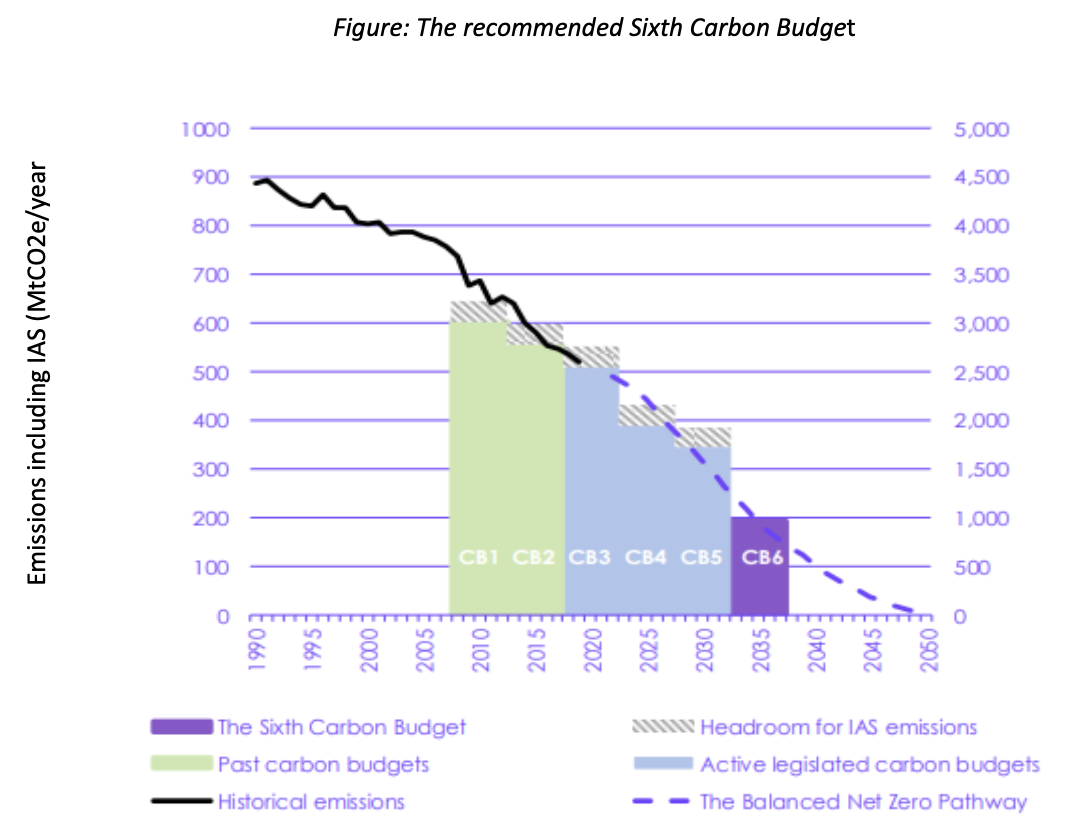

The United Kingdom (UK) plans to reduce the net emissions of greenhouse gases by 100 Percent relative to 1990 levels by 2050. As such, the UK has been a leader in climate change with greenhouse gas emissions falling over the past 30 years. In 2018, UK emissions stood at 57 Percent of their 1990 levels. Furthermore, The Climate Change Act 2008 requires the government to set five-yearly carbon budgets, after taking advice from the UK's Climate Change Committee.(1)

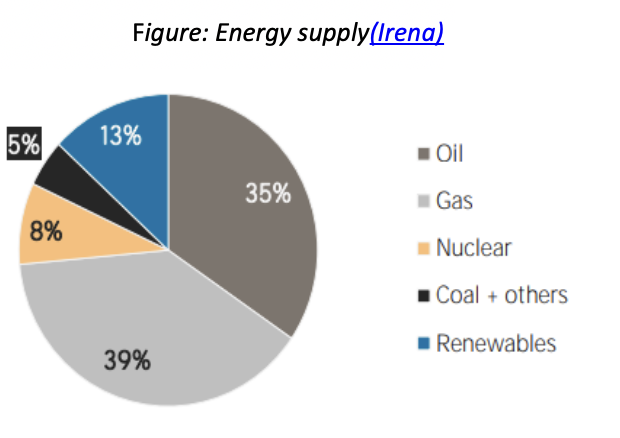

The United Kingdom's energy supply is primarily dependent on oil and gas, while also having significant Nuclear and renewable energy. Supply from coal and other sources is fairly restricted.

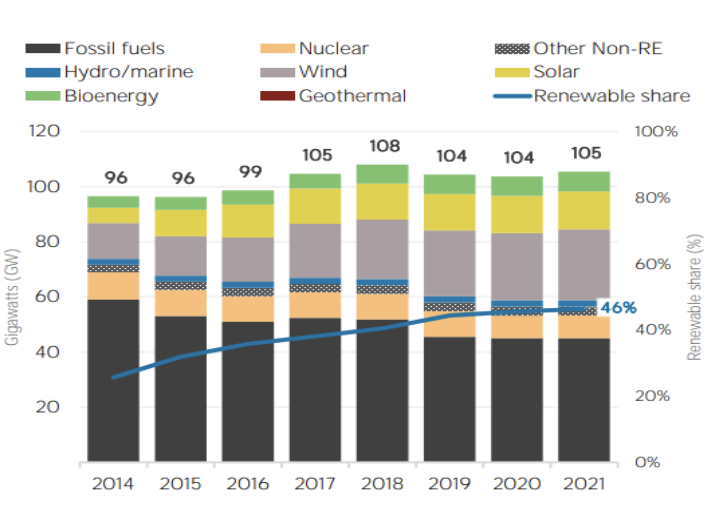

The installed capacity trend of the United Kingdom shows an increasing capacity of renewable energy at a CAGR of 46 Percent. This is while the total capacity has remain relatively stable. The installed capacity of fossil fuels can also be seen decreasing. It can thus be inferred that RE has been substituting fossil fuels

Presently, the UK's hydrogen production and use is heavily concentrated in chemicals and refineries. Hydrogen is also used as a fuel, in smaller volumes through hydrogen cars, trucks, buses and marine vessels. The hydrogen used today is primarily produced from natural gas(2 )

Going forward, the UK has set a target of 10GW of low carbon hydrogen production capacity by 2030. In order to meet the UK's climate goals, the Department for Business, Energy and Industrial Strategy suggests 250-460 TWh of hydrogen could be needed in 2050, making up 20-35 per cent of UK final energy consumption.(2)

In order to meet the consumption goals, the United Kingdom is considering multiple production pathways for low-carbon hydrogen

| Production method | Role to 2030 / 2050 | Next steps |

|---|---|---|

| Steam methane reformation without carbon capture | Small amounts of existing supply have helped prove end use case in tests / trials. | Decarbonise existing use in industry |

| Steam methane reformation (SMR) or autothermal reformation (ATR) with carbon capture | Large scale projects expected from mid- 2020s, bulk supply to kick start UK hydrogen economy | Carbon capture and storage infrastructure needs to be in place |

| Grid electrolysis | To be determined based on further policy development | Further engagement and analysis required, e.g. via the consultation on the UK Low Carbon Hydrogen Standard |

| Renewable electrolysis | Small projects expected to be ready to build in early 2020s | Scale up technology, reduce costs over time |

| Low temperature nuclear electrolysis | Can apply existing technologies to current plants in the 2020s. | Further developments expected in 2020s. |

| High temperature nuclear electrolysis | Could develop hydrogen from advanced nuclear for 2030s | Further innovation and developments expected in 2020s. |

| Bioenergy with carbon capture and storage (BECCS) | Could begin production in 2030s | Further innovation and developments expected in 2020s. Developing position further in forthcoming Biomass Strategy |

| Thermochemical water splitting | Could develop hydrogen from advanced nuclear for mid-late 2030s | Further innovation work to develop to commercial technology |

| Methane Pyrolysis | Nascent technology still to be proven at scale | R&D / Innovation |

The United Kingdom has put in a few key policy measures which will allow for the fast uptake of low-carbon hydrogen.

| Scheme(2) | Aim of programme | Funding available | Status |

|---|---|---|---|

| Net Zero Hydrogen Fund | The Net Zero Hydrogen Fund will fund the development and deployment of new low carbon hydrogen production to de-risk investment and reduce lifetime costs. Both strands are designed to support multiple low carbon hydrogen production technologies that meet the eligibility criteria. | Total: £240 million Breakdown: Strand 1: DEVEX grant up to 50% co-funding for FEED and post-FEED studies, Grant awards of £80k–£15 million Strand 2: CAPEX grant up to 30% co-funding, Grant awards of £200k–£30 million | Award to be announced in 2023. Further rounds intended to open in the future |

| Hydrogen Production Business Model | Hydrogen Business Model (HBM) incentivises the production and use of low carbon hydrogen through the provision of ongoing revenue support. | Ongoing revenue support - will be funded by government until the hydrogen levy comes into effect | Award expected to be announced in 2023. Further rounds intended to open in the future |

| NZIP Industrial Hydrogen Accelerator | Demonstrate end-to-end industrial fuel switching to hydrogen to provide evidence on feasibility, cost and performance. | Up to £26 million | One demonstrator project running (stream 1). Awards for demo funding for best of the feasibility projects are pending. |

| NZIP H2BECCS innovation competition | Supports innovation in hydrogen BECCS (bioenergy with carbon capture and storage) technologies | £30 million | Awards pending |

| UKRI Hydrogen storage and distribution supply chain innovation competition | Support development of hydrogen storage and distribution systems, reducing the associated cost of hydrogen supply chains and encouraging the commercialization and adoption of hydrogen storage and distribution innovation in the UK | £4.5 million | Open for bids until 26.4.23 |

| NZIP Low Carbon Hydrogen Supply 2 innovation competition | To provide funding for projects that can help develop a wide range of innovative low-carbon hydrogen supply solutions | Up to £60 million | 5 'Stream 2' quick- start projects underway. Awards for demo funds for best feasibility projects to be announced soon. |

The UK generates more electricity from offshore wind than any other country. It plans to quadruple offshore wind capacity to 40GW by 2030. This low carbon electricity will be the primary route to decarbonization for many parts of the energy system and will also support electrolytic production of hydrogen. Furthermore, the UK also has favorable geology for large-scale storage of hydrogen, and is already storing hydrogen in salt caverns and exploring storage in disused oil and gas fields under the North Sea.

Not Available (NA)